Star and Crown Casino – Back On The Radar

Star reported normalised NPAT of $120m, up 12% on the same time last year and revenue growth was strong, up 16%.

FY19 revenue is forecast to be $2.9b, EBIT $430m, DPS $0.16, placing the stock on a forward yield of 3%.

Investors should watch for the next Algo Engine buy signal in both Star and Crown as they approach a new higher low formation, which will provide a good entry level.

Star Casino

Crown Casino

Sydney Airport

Sydney Airport Transurban

Transurban

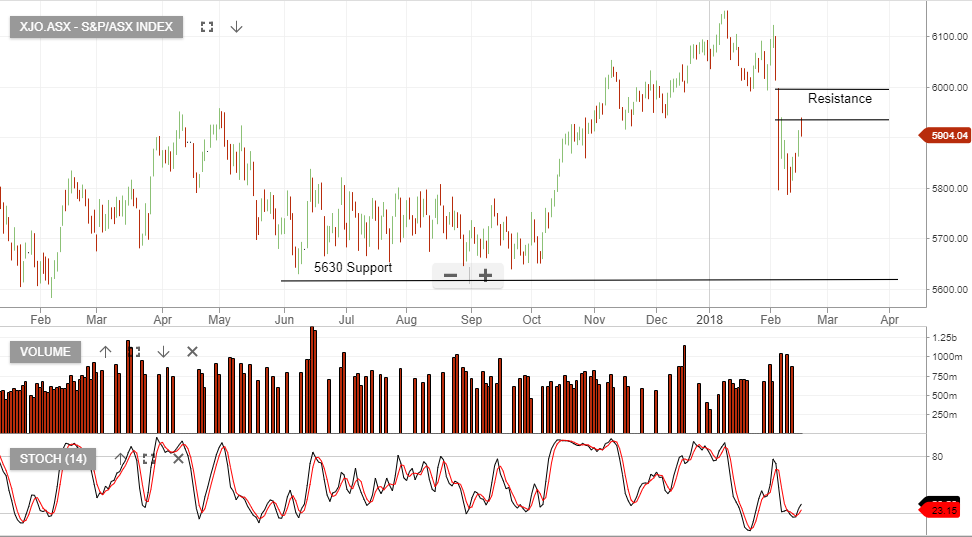

ASX:ASX

ASX:ASX