Australian banks have been oversold, and over the past two weeks we’ve seen capital flows reallocated towards the sector.

NAB has now rallied $2.00 or 6% since the beginning of February.

Limited revenue growth has created a “shrink to grow” strategy among all of the major banks, along with a renewed focus on cost control.

Due to the delay in benefits from the strategy being passed through to shareholders, we believe the current share price rebound will be limited.

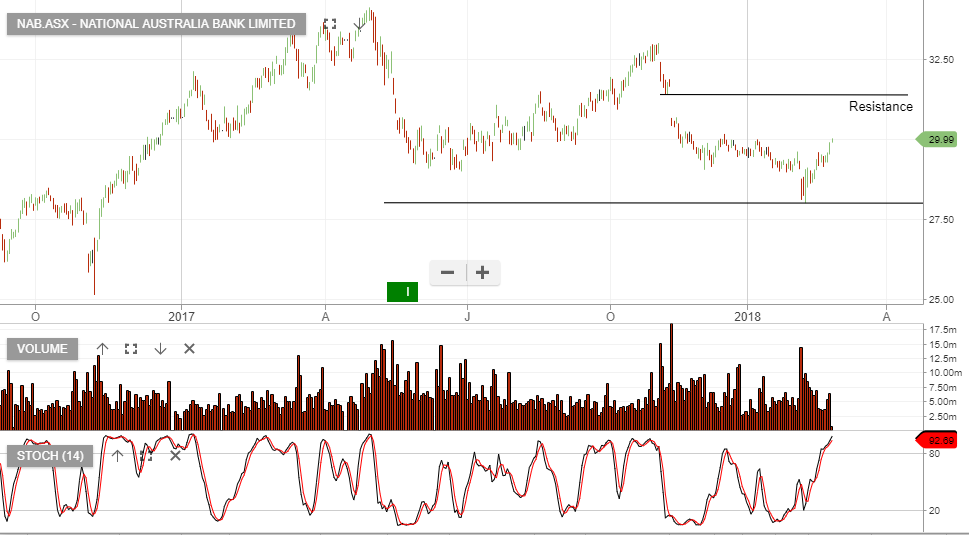

The NAB chart below perfectly illustrates the range where we expect selling pressure is likely to build.

NAB