Since posting a intra-day high of $12.05 on January 10th, shares of BEN have dropped over 6% and have slipped to a 2-month low of $11.32 in early trade.

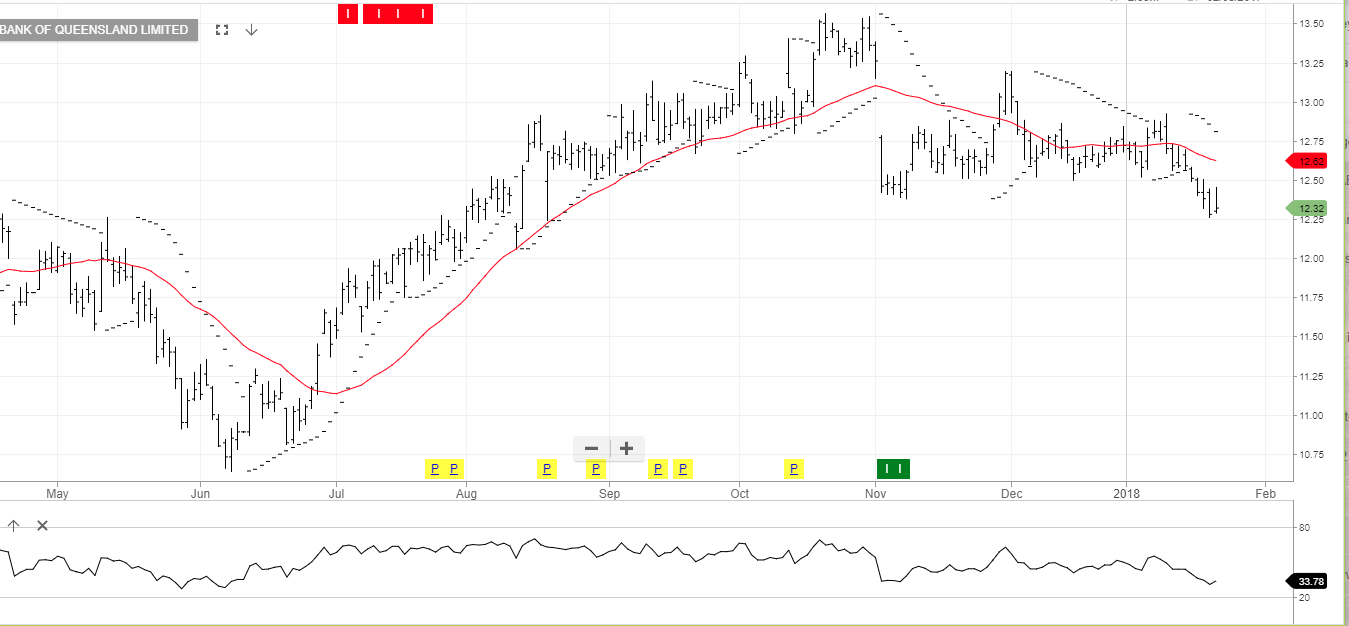

Similarly, shares of BOQ have lost 4.6% since the start of the year and posted a 5-month low of $12.26 last Friday.

Recent mortgage forecasts have illustrated that in an overall loan market which is contracting, the regional banks will face the strongest headwinds to achieving the margins and loan growth that they have created over the last three years.

Our ALGO engine triggered a sell signal for BEN on August 16th at $12.45, and for BOQ at $15.50 on August 7th.

This has been a popular “short” trade for investors on our SAXOGo platform.

We expect the next level of downside support at $11.00 for BEN and $12.05 for BOQ.

Bendigo Bank

Bank of Queensland