Since December 1st, the price of WTI Crude Oil has rallied over 14%.

Just in the last 5 days the WTI price has risen 5% from $60.25 to a 3.5 year high today of $63.50.

Recent reductions in crude inventories combined with Geo-political tensions in the Middle-East have support prices.

However, there have been many analyst sceptical that this will be a protracted rally in Crude prices.

This scepticism can be seen in the price action of some of the local oil-based names.

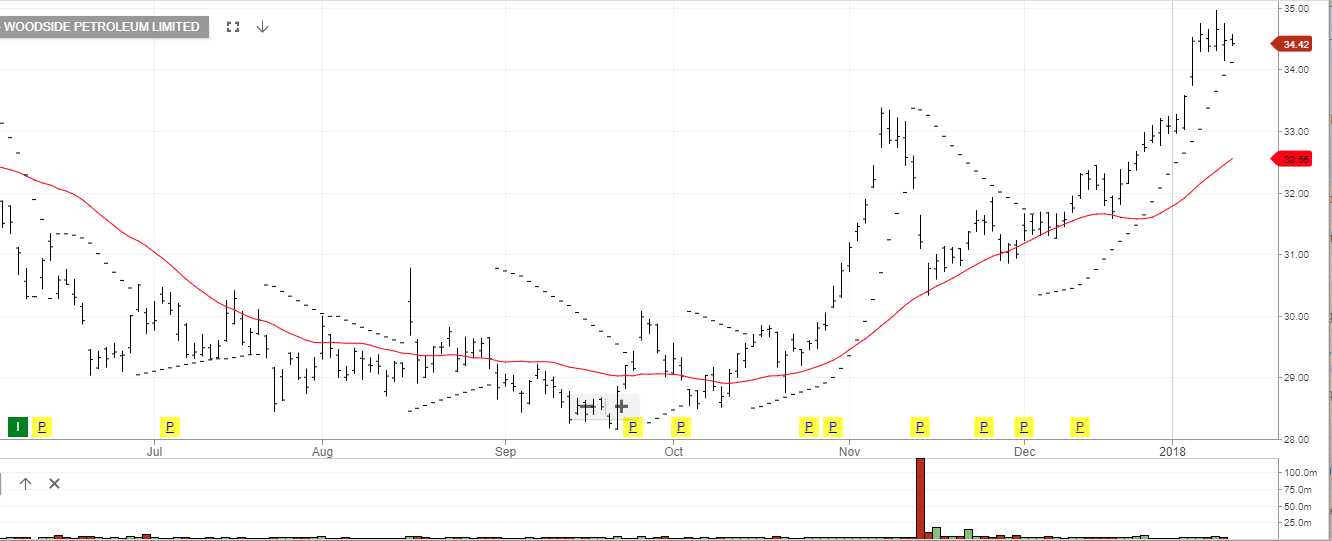

Despite the 5% rise in WTI over the last week, shares of OSH have dropped by 2.5% to $7.90, and the share price of WPL and STO have been consolidating off their recent highs and look to be pointing lower.

We urge caution on the sustainability of the recent run up in Crude prices and would suggest exiting long exposure to WPL, STO and OSH

Woodside

Santos

Oil Search