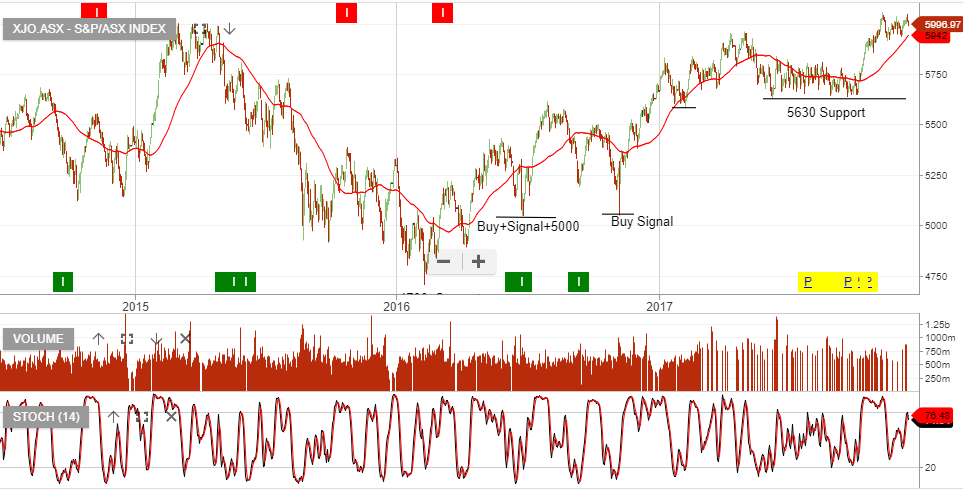

S&P/ASX 200 finished the week up 0.04%

The S&P/ASX 200 Index finished the week up 0.04%.

The best performer was the Property Trusts sector, up 1.8% and the the worst performer was the Utilities sector, down 3.8%.

The S&P/ASX 200 Index finished the week up 0.04%.

The best performer was the Property Trusts sector, up 1.8% and the the worst performer was the Utilities sector, down 3.8%.

Our Algo Engine has triggered a buy signal in the Vaneck Vectors Gold Miners ETF with the ASX symbol GDX.

The price of Spot Gold has been very active and has traded in a $50.00 range between $1290.00 and $1240.00 since December 1st.

We estimate that a move back to $1290 in Spot Gold will translate to a share price of $30.40 in GDX.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Our ALGO engine triggered a buy signal on Newcrest Mining at $21.90 yesterday.

Clients and subscribers were notified via email that NCM has been added to our ASX Top 50 portfolio listed in the Premium section of the blog.

The recent slide in Spot Gold prices has impacted domestic Gold producers unevenly. Shares of the smaller firms like SBM, EVN and SAR have held their value and even firmed over recent sessions relative to NCM.

We believe that NCM’s recent sale of its 89.9% stake in Bonikro mine in Cote d’Ivoire has caused some short-term pressure to the share price value investors will support the share price in the $21.80 area.

The current momentum indicators are in oversold territory and the ALGO engine flagged the “higher low” formation based on the October lows near $20.90.

As the price of Spot Gold moves back into the $1300 area, we expect NCM shares to move back into the high $24.00 handle.

Newcrest

Newcrest

Our ALGO engine triggered a buy signal for InvoCare at $16.40 on yesterday’s ASX close.

The stock looked very expensive when it posted a high trade of $18.10 on December 4th. Since then the company has been the target of several negative analyst’s reports and the share price dipped to $16.25 in early trade today.

The ALGO engine has flagged the “higher low” pattern based on the low price in the $13.00 area back in early August.

We don’t expect the IVC share price to rally back to the $18.00 area in the near-term.

However, we believe with the internal momentum indicators in oversold territory, a move back to the $17.35/40 area is a reasonable trade for both share investors and CFD traders on our SAXO Go platform.

InvoCare

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

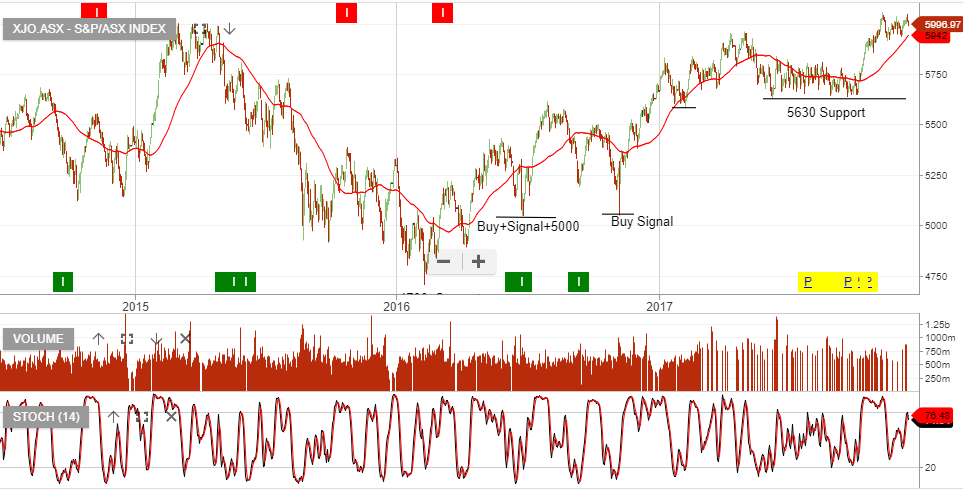

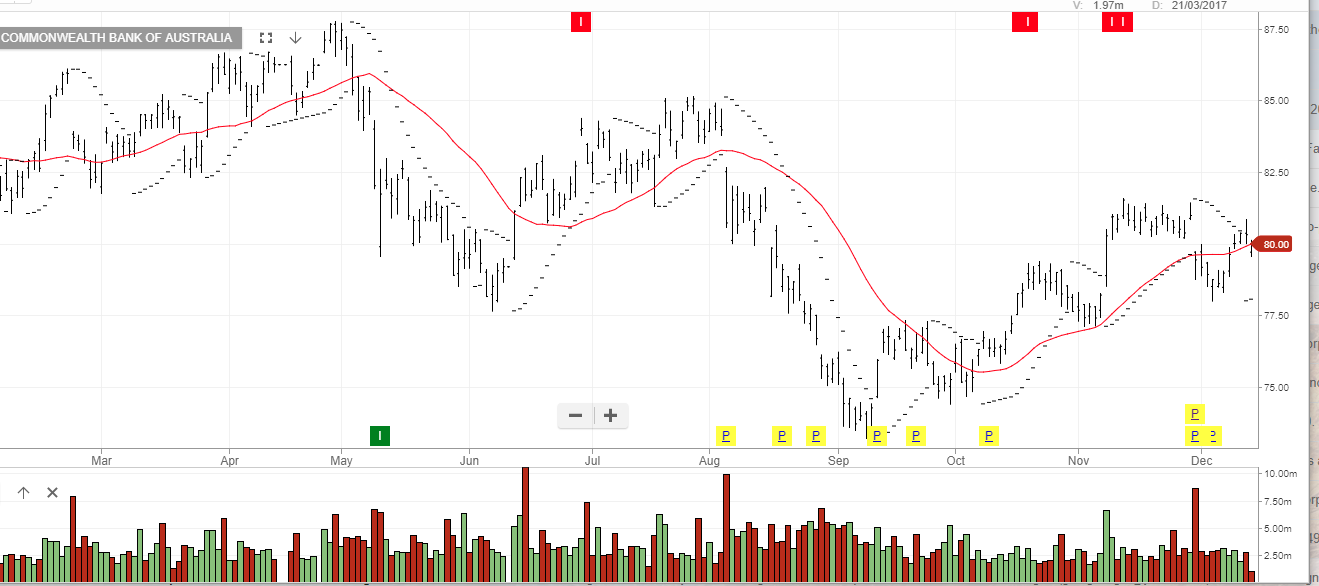

In what could be described as the largest plea deal in Australian corporate history, CBA admitted it breached the AUSTRAC money laundering regulations over 53,000 times.

The bank’s lawyers argue that a “computer glitch” was the cause for the breach and they are proposing that AUSTRAC prosecutes all of the 53,000 breaches as one infraction, as opposed to each one separately.

CBA also said it will defend more than 100 more serious allegations regarding failure to disclose suspicious transactions.

Our ALGO engine triggered a sell signal on November 13th at $81.52.

The share price has traded down to $79.55 and is still under a “lower high” chart structure. The combination of negative internal momentum indicators and growing fundamental headwinds keeps our trading bias negative on CBA.

The next significant support area is near the December 7th low of $78.30.

CBA

CBA

Shares of Caltex spiked 5% higher at the open as the ACCC ruled against the proposal for Woolworths to sell its portfolio of 527 service stations to BP; an estimated $1.8 billion deal.

After reaching a high of $35.00, CTX shares have now drifted lower but are still up over 4.0% at $34.80.

The price structure is still under the December 5th high of $35.70, which reflects a “lower high” trading pattern.

Caltex

Or start a free thirty day trial for our full service, which includes our ASX Research.