In what could be described as the largest plea deal in Australian corporate history, CBA admitted it breached the AUSTRAC money laundering regulations over 53,000 times.

The bank’s lawyers argue that a “computer glitch” was the cause for the breach and they are proposing that AUSTRAC prosecutes all of the 53,000 breaches as one infraction, as opposed to each one separately.

CBA also said it will defend more than 100 more serious allegations regarding failure to disclose suspicious transactions.

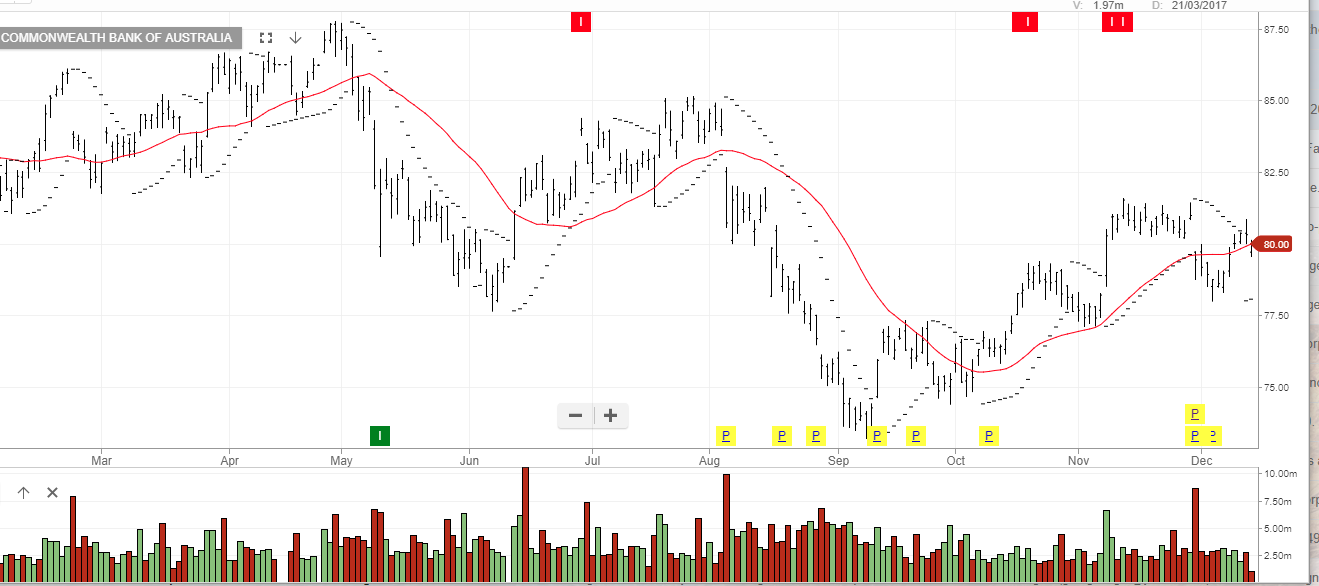

Our ALGO engine triggered a sell signal on November 13th at $81.52.

The share price has traded down to $79.55 and is still under a “lower high” chart structure. The combination of negative internal momentum indicators and growing fundamental headwinds keeps our trading bias negative on CBA.

The next significant support area is near the December 7th low of $78.30.

CBA

CBA