Woodside Petroleum – Buy the Dip

Woodside Petroleum has now sold off $2.00 since making a high of $33.37 on the 7th of November.

After having a recent profitable trade in WPL, we again look to the buy side on further price retracement and view $30 – $30.75 as a low risk entry level.

Shell has announced the sale of 71 million shares or 8.5% of WPL’s register. Shell’s ownership will be reduced to 4.8%. The consideration will be approximately A$2.2billion.

Woodside

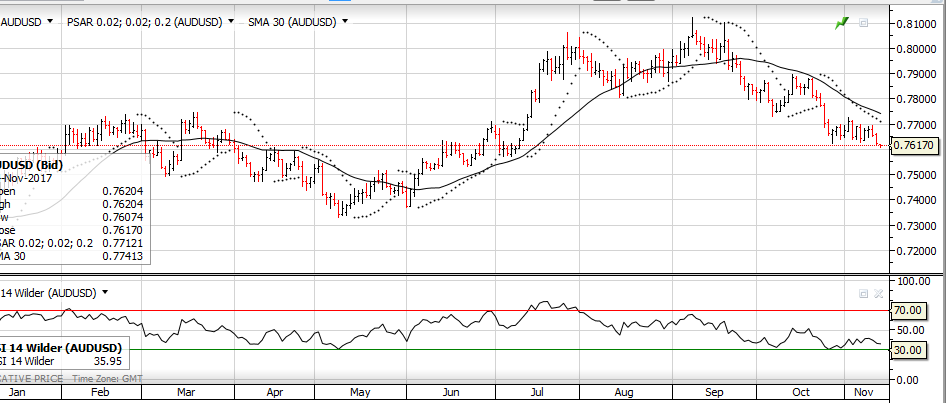

Aussie Dollar

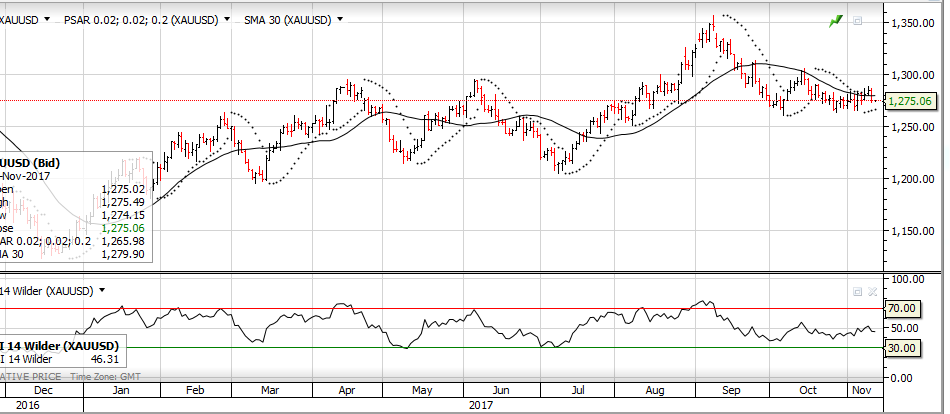

Aussie Dollar Spot Gold

Spot Gold