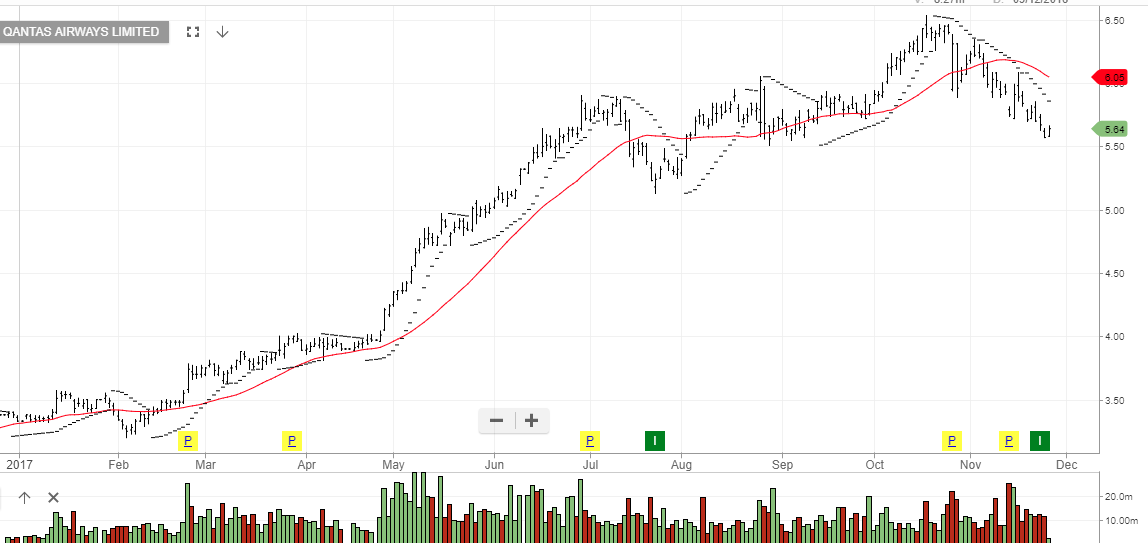

Our ALGO engine triggered a buy signal in QAN last Friday at 5.60.

Since posting a 52-week high at $6.53 on October 18th, QAN shares have traded down to a low of $5.57 last Thursday.

Technically, the share price is still tracking a “higher low” pattern which is bullish and suggests the recent sell off is a correction within a broader uptrend.

the company is currently trading on a P/E of 13X and will likely improve on the FY 17 after tax profit of $853 million announced back in October.

QAN is also one of the ASX companies that will benefit from a weaker Aussie Dollar as inbound tourism is likely to increase.

Over the near-term we are looking the share price to reach the $6.25 area.

QANTAS