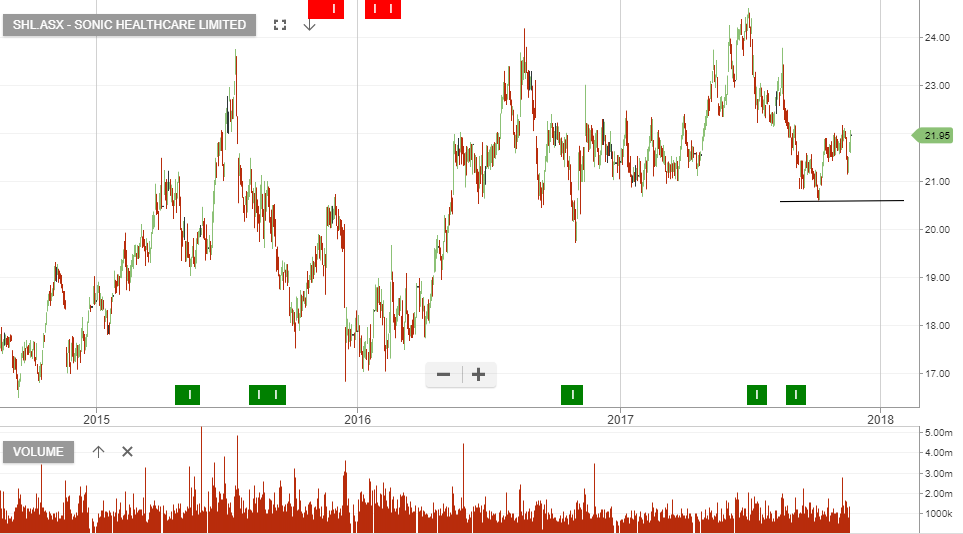

We hold Sonic Healthcare in our ASX 50 model portfolio, following recent Algo Engine buy signal.

FY18 net profit is likely to be around $470m on $5.5b in revenue, if we assume 5% EPS growth in FY19 and FY20 we get to a forecast net profit of $520m in FY20.

The above growth will see dividends expand from the current $0.77 per share, to $0.86 in 2020.

Like many top 50 companies, we see Sonic as a defensive contributor to portfolios but hardly at compelling value. It’s only when adding a covered call option that the risk return scenario starts to add up.

We allow moderate capital growth and look to sell $22.50 calls on the other-side of the March dividend, helping us to drive 10 – 12% cash flow from SHL on an annualised basis.