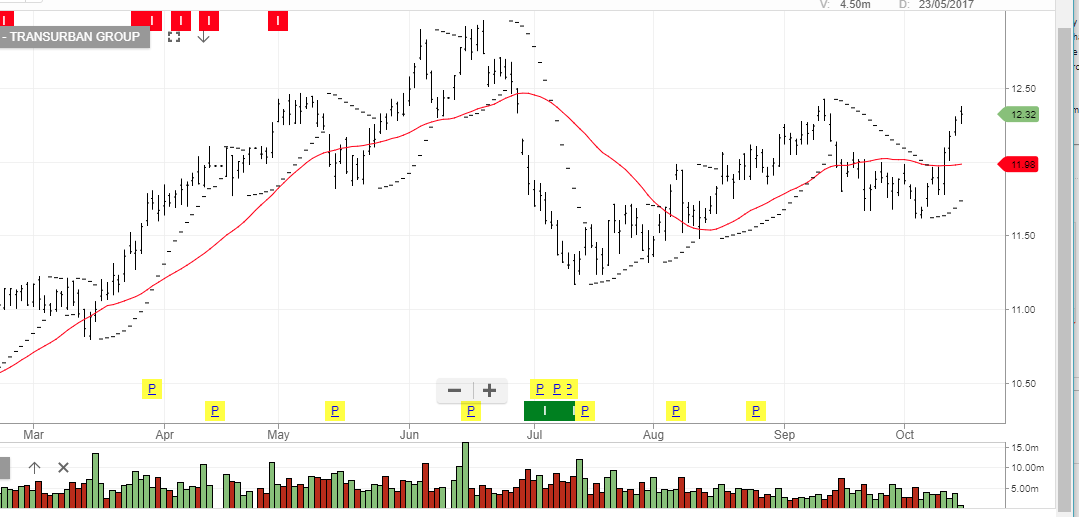

On October 5th, shares of TCL traded as low as $11.62. At that time the US 10-year bonds were yielding 2.40%.

US yields have now dropped to 2.28% and TCL’s share price is over 6% higher at $12.30.

This interest rate correlation and sensitivity is linked to several other ASX stocks including WOW, SYD and SCG.

With the odds of a FED rate hike in December still over 70%, we see limited upside in TCL beyond $12.50.

As such, we like selling the $12.50 TCL calls into March and collecting the 40 cents premium.

In addition, TCL is set to pay a 27 cent dividend in December, which will bring the total cash flow from the derivative overlay strategy to 67 cents.

Transurban Group