Spot Crude Oil prices dropped over 2% after comments from a Saudi official that the November OPEC meeting may not result in an extension to the current production cut agreement.

This announcement comes as the return of supply from Libya and increasing rig counts in the USA have kept prices under pressure.

For the week, the front month November Crude Oil contract fell close to 5%.

Technically, Friday’s settlement at $49.25 is the first close below the 200-day moving average since September 10th, which suggests near-term range extension to the downside.

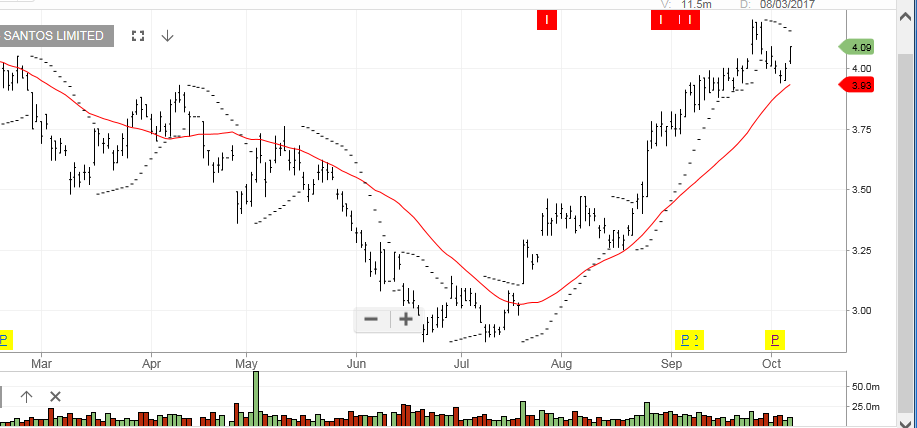

Our ALGO engine triggered a sell signal in OSH on September 28th at $7.10, and a sell signal in STO on September 26th at $4.20.

These trades have been slow to develop but we maintain our downside targets of $6.30 in OSH and $3.35 in STO

Oil Search

Oil Search

Santos

Santos