US Stock indexes may have dodged a bullet today when President Trump defied his White House advisors and sided with Democrats to defer the debt ceiling debate until December.

Using the legal structure of a “continued resolution” linked to emergency aid to victims of hurricane Harvey, the proposal would suspend the borrowing cap, currently at $19.9 trillion, until December 15th.

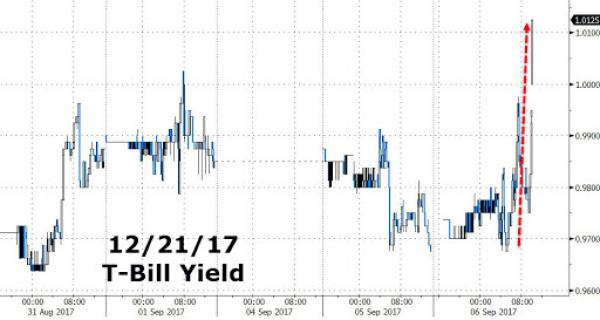

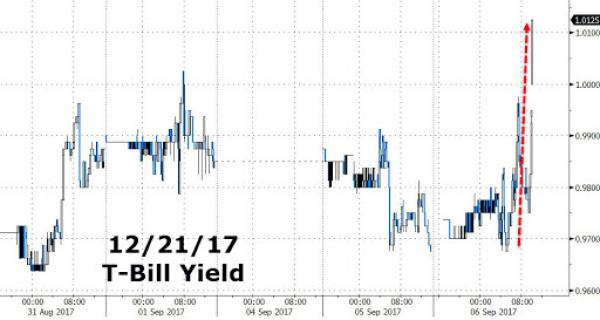

And while this manoeuvre calmed the nerves of T-Bill investors into the October maturity, the fear premium of a government shutdown has just been transferred to the December maturity.

Over the next few days we expect to hear more about how this political tactic will impact the administration’s legislative goals on tax reform, infrastructure programs and border security.

The prime risk to US equity markets is that credit agencies view this failure to address the debt ceiling as cause to downgrade US Sovereign debt ratings.

In short, “kicking the can” down the road has not made US assets less risky at current levels.

December T-Bill Yields

December T-Bill Yields

December T-Bill Yields

December T-Bill Yields

Santos

Santos