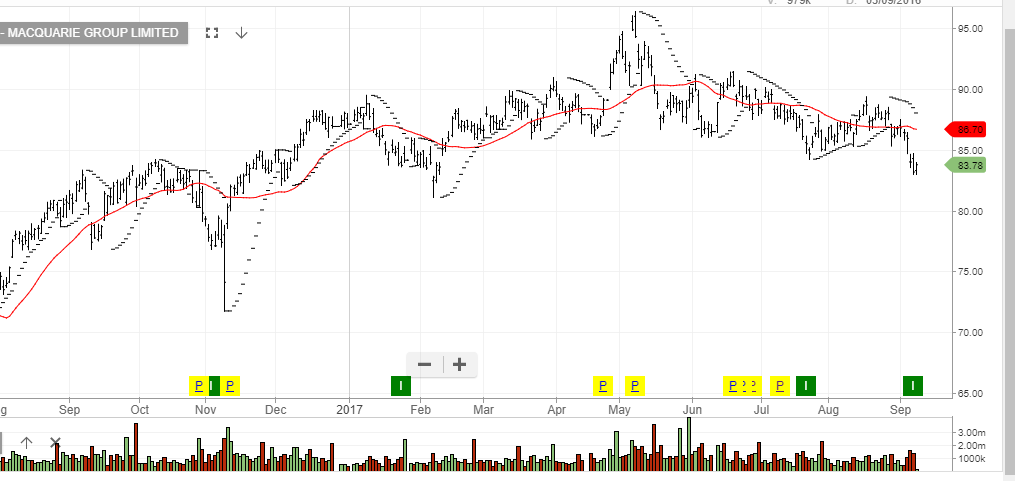

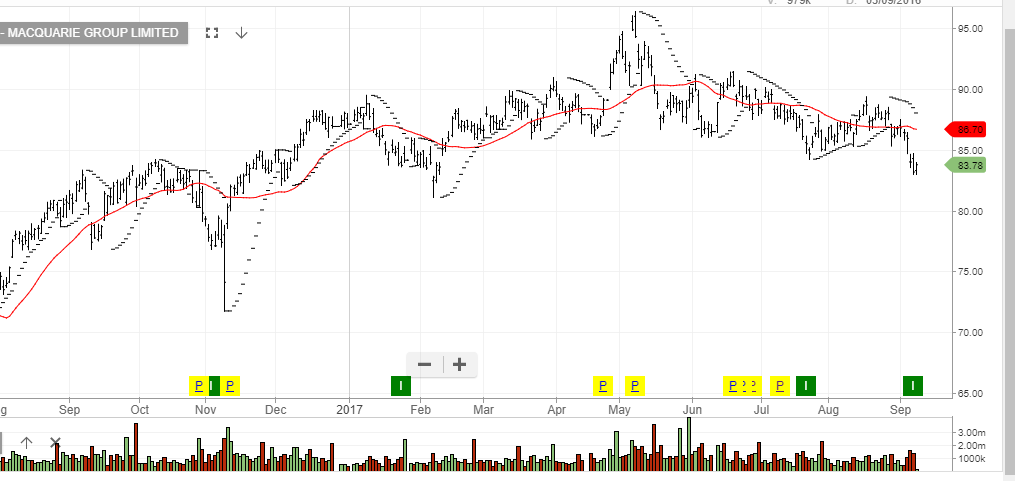

The ALGO engine triggered a buy signal on MQG at yesterday’s ASX close at $83.01.

The stock has dropped over 7% since posting an intra-day high at $89.35 on August 17th.

This swift decline has pushed internal momentum indicators into an “oversold” area, which the technical ALGO engine picked up on when creating the buy signal.

We remain cautious of the forward earnings potential in the local banking sector and will monitor this trade over the next few trading sessions.

At this point, we would consider any move in MQG up into the $84.90 area as a corrective reversion and an area to sell long holdings or establish short positions.

Macquarie Group

Santos

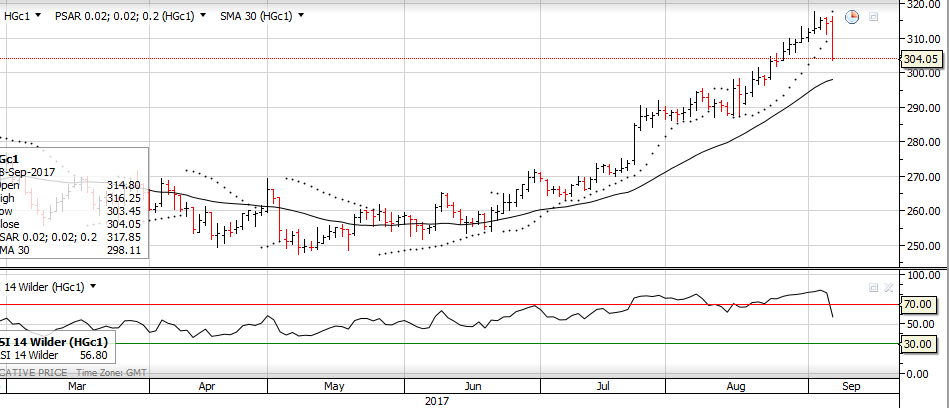

Santos Crude Oil

Crude Oil Sandfire Resources

Sandfire Resources NY High-Grade Copper

NY High-Grade Copper