Woolworths – Approaching Support

Keep Woolworths on your radar as we’re likely to see an exhaustion to the current selling pressure and a bounce higher.

Woolworths

Keep Woolworths on your radar as we’re likely to see an exhaustion to the current selling pressure and a bounce higher.

Woolworths

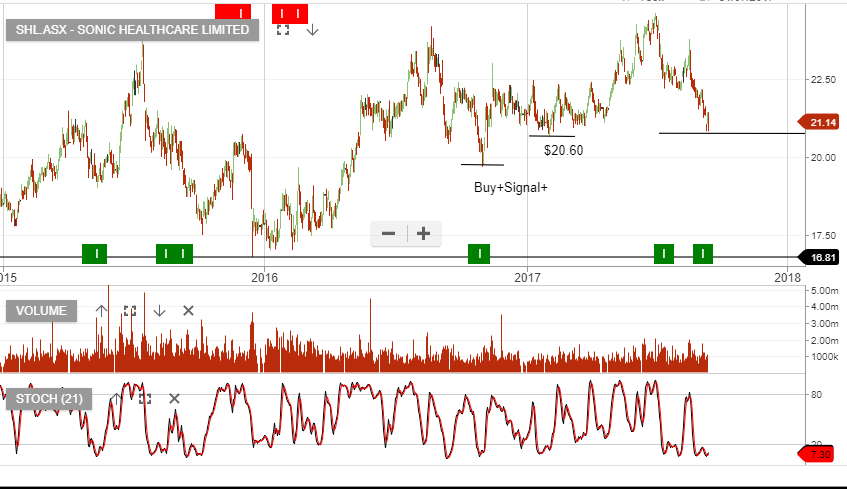

Our Algo Engine triggered a buy signal in SHL near the recent low. We continue to see a buy-side opportunity here at $21.00

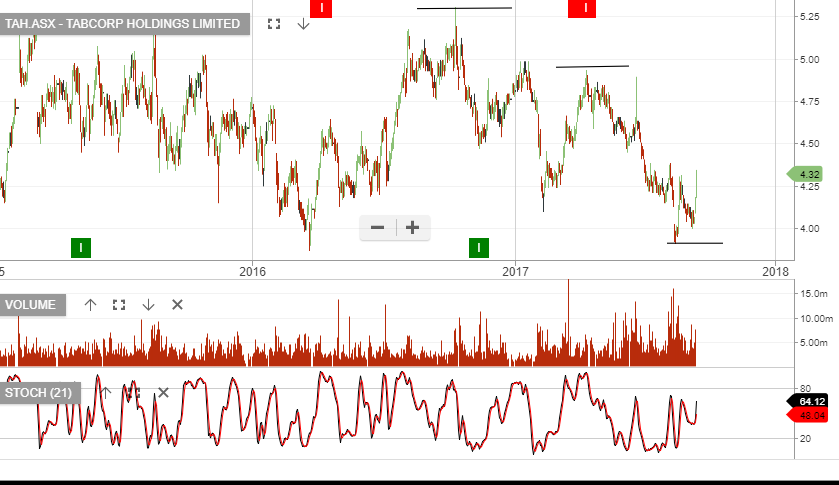

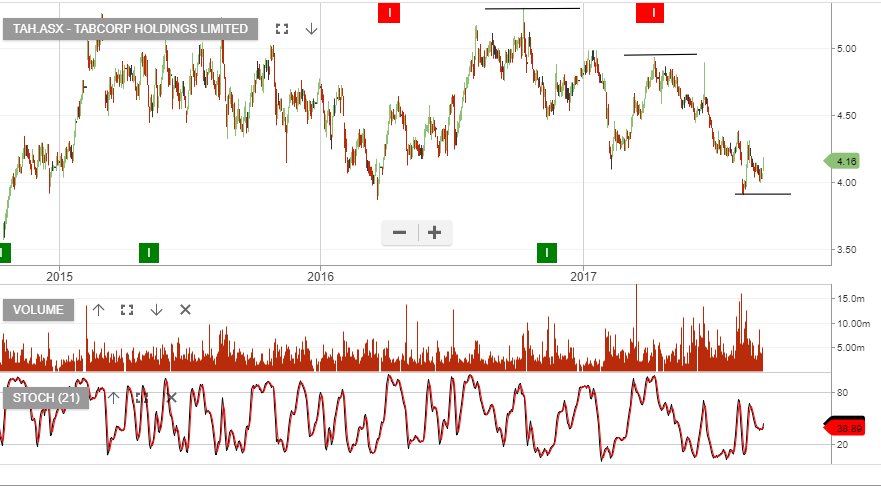

TAH has bounced from the $4.05 level highlighted in last weeks blog post and is now moving high, towards our $4.50 target.

We feel traders should look to sell into the current price rally in BOQ.

Slowing credit growth conditions will act as a headwind to mortgage profitability and with BOQ now trading at the top end of the valuation range, any further price extension provides a good opportunity to set a position on the short side.

We have BOQ delivering flat EPS growth of $0.93 and DPS of $0.77, placing the stock on a forward yield of 5.6%

Bank of Queensland

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

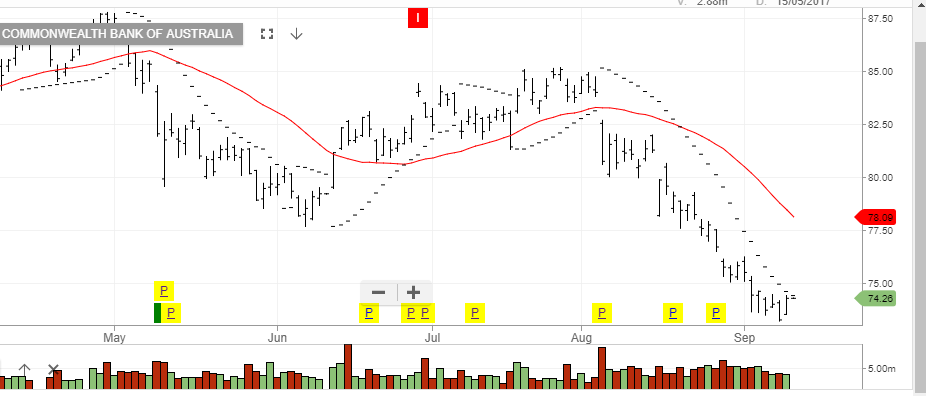

Shares of CBA have traded back over $75.00 in early trade on the back of solid gains in the US banking sector on Wall Street.

However, we see this as a brief corrective move within the broader 8% decline over the last month.

A report from Credit Suisse this morning suggests that the CBA could face a $200 million increase in its annual operating costs over the next two years because of legal fees and related costs to defend the AUSTRAC money laundering accusations.

Our ALGO engine triggered a sell signal in CBA on July 4th at $84.00. We see solid technical resistance in the $75.60 area and more range extension to the $70.00 handle over the medium term.

Commonwealth Bank

Commonwealth Bank

Our Algo Engine triggered a buy signal in Crown near the recent low of $11.43.

Apply a stop-loss on a break below $11.40

Crown

Tabcorp is likely to trade higher, into the $4.50 range following independent expert Grant Samuel indicating the proposed $11 billion merger of gaming giants Tatts Group will deliver fair value for Tatts shareholders.

Tabcorp says the merger is expected to deliver at least $130 million in annual earnings from what it calls synergies and business improvements, tech integration, corporate cost savings and other consolidations.

It will take about two years to fully integrate the old Tabcorp and Tatts businesses, according to Tabcorp.

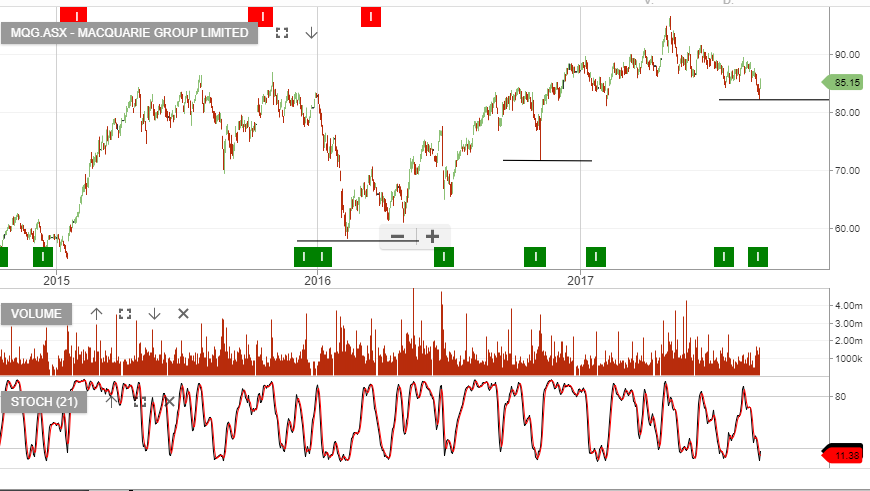

Our Algo Engine triggered a buy signal in MQG near the recent low of $82.28.

During an outlook update provided to the market, MQG re-affirmed guidance for its FY18 result to be broadly in line with FY17. Management noted that, strong revenues in the FUM business will help underpin FY18 earnings.

FY18 cash earnings of $2.3b, EPS $6.70 and DPS $4.70, represents 3 – 5% earnings growth on FY17 and places the stock on a forward yield of 5.4%.

There appears to be short-term upside price momentum from the recent signal, however, stop losses below the $82.28 low are advised.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.