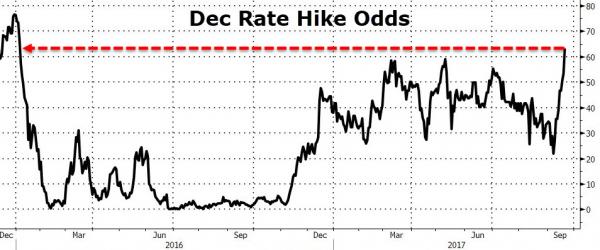

As expected, the US FOMC voted to keep rates unchanged last night but signalled that it still expects one more rate hike before the end of the year.

If that’s the case, then the FED Funds target will have been lifted from .25% to 1.50% in just over 12 months. The “Dot plots” were revised slightly lower from 3.0% to 2.75% by the end of 2019.

The response from US stock indexes was muted, but we expect the combination of higher borrowing costs and the reduction of the FED balance sheet to temper any significant gains in US equities into the end of the year.