This coming Tuesday and Wednesday, the FOMC will meet to discuss the next move in US monetary policy.

Over the last several months, it’s been well-telegraphed that this meeting will focus on unwinding QE and shrinking their balance sheet. The amounts and the mechanics have already been announced. Now it’s just a matter of announcing a starting date.

US financial markets have been brushing off the Fed and have done the opposite of what the Fed has set out to accomplish.

The Fed wants to tighten US financial conditions. It’s worried about asset prices and that these inflated assets, which are used as collateral by the banks, pose a danger to financial stability.

The FED has mentioned several inflated asset classes by name, including equity prices and commercial real estate, which backs $4 trillion in loans heavily concentrated at regional banks.

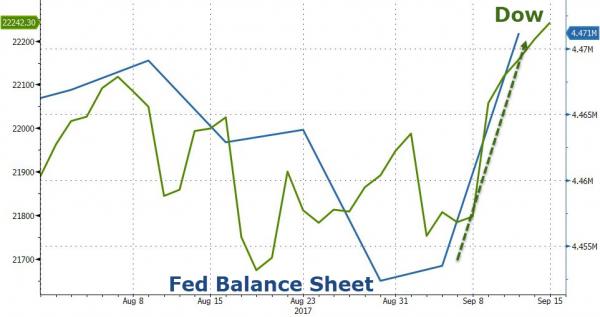

The FED has raised rates four times since December 2015, including three times over the past nine months. As the chart below illustrates, the relationship between the DOW Jones Index and the FED’s balance sheet is highly correlated.

As such, the FED’s decision could be a prime driver of US equities next week.