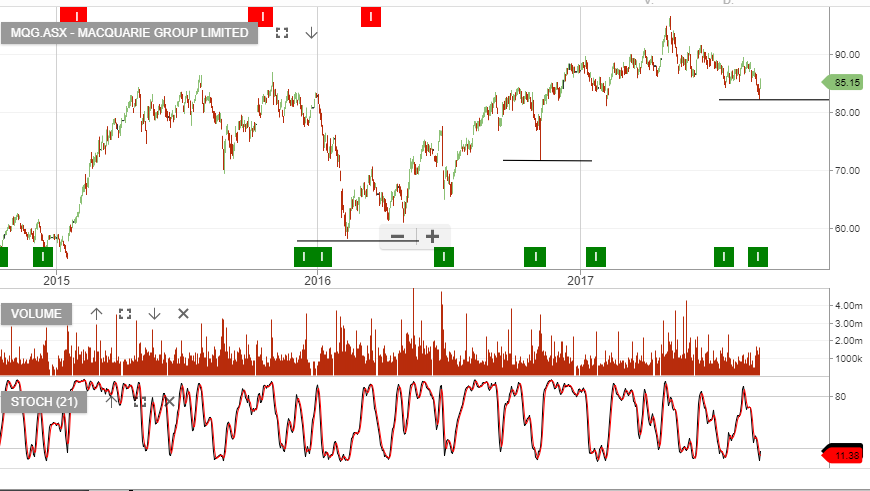

Our Algo Engine triggered a buy signal in MQG near the recent low of $82.28.

During an outlook update provided to the market, MQG re-affirmed guidance for its FY18 result to be broadly in line with FY17. Management noted that, strong revenues in the FUM business will help underpin FY18 earnings.

FY18 cash earnings of $2.3b, EPS $6.70 and DPS $4.70, represents 3 – 5% earnings growth on FY17 and places the stock on a forward yield of 5.4%.

There appears to be short-term upside price momentum from the recent signal, however, stop losses below the $82.28 low are advised.