Black Monday 2011, Revisited

Just over six years ago, August the 2nd 2011 to be exact, the US Congress avoided a Sovereign default and finally reached an agreement to raise the US debt ceiling from $14.29 trillion to $15.77 trillion.

The legislation was called the “Budget Control Act of 2011”, and was signed on the same day by President Barack Obama.

During the negotiations, credit agencies, Moody’s, Fitch and Standard and Poor’s all advised lawmakers that the US AAA credit rating was going to be reviewed regardless of the debt ceiling legislation.

After the market closed on Friday, August 5th, several rating agencies downgraded the US credit rating to AA+ .

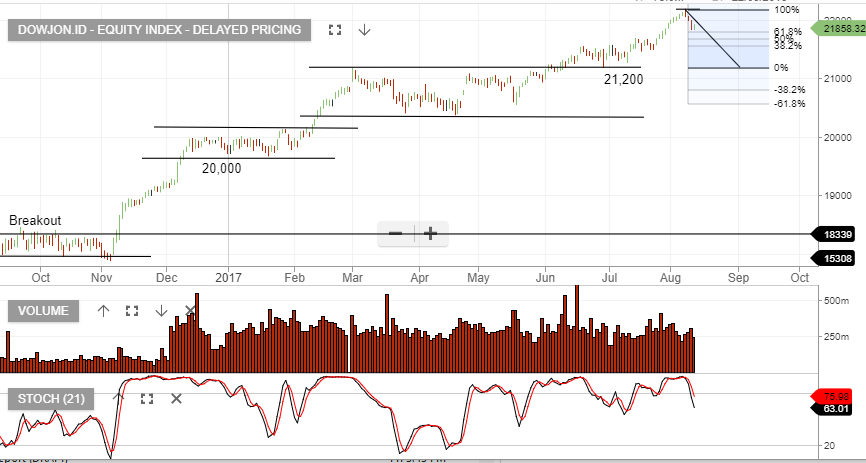

This triggered a massive selloff on Monday, August 8th, where The NASDAQ Composite Index fell 174.72 points (-6.90%), the SP 500 Index shed 79.92 points (-6.66%), and the Dow Jones 30 Index lost 634.76 points (-5.55%).

The aggregate loss on the day was over $1 trillion.

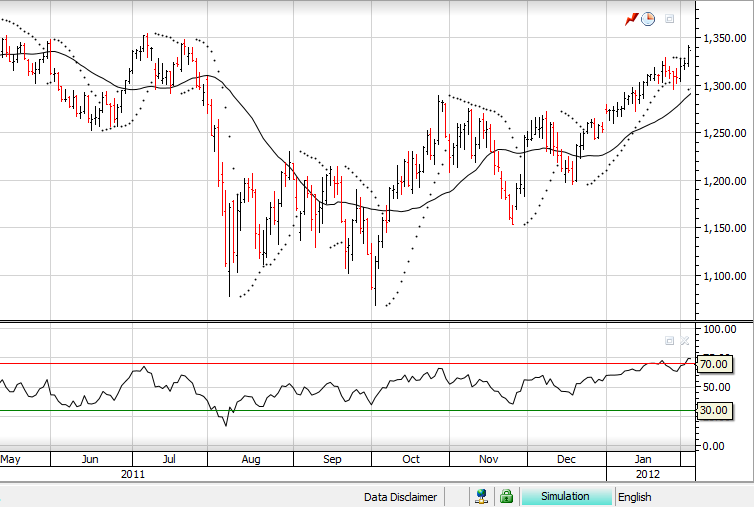

As the chart below illustrates, the fall out from the 2011 debt ceiling crisis led to the SP 500 losing 208 points, or 16.1% in just 6 trading days.

The US Congress and the White House have already commenced discussions about raising the debt limit from the current level of $19.80 trillion, with a September 29th deadline.

Considering the market’s inflated valuations based on tax cuts and infrastructure spending, domestic issues with consumer credit and autos loans, and the escalation of geopolitical risks, we suggest caution that this time the US equity market sell off could be much greater.

SP 500 August 2011.

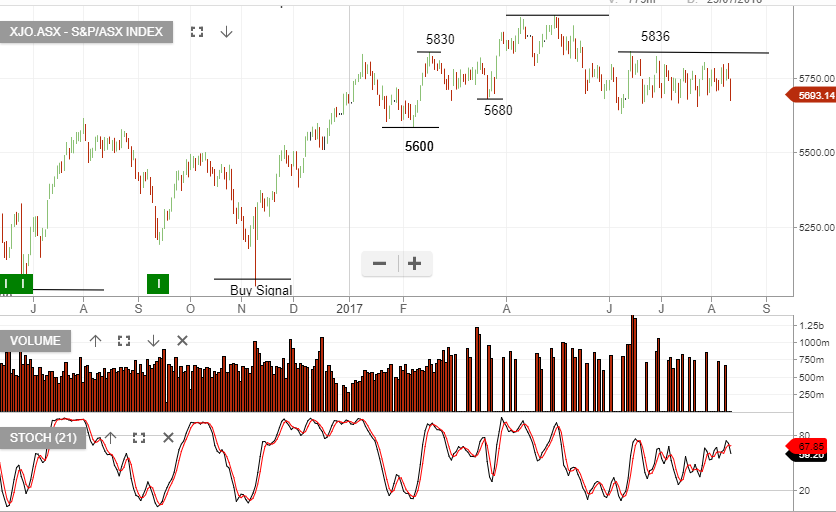

Telstra

Telstra VIX Volatility Index

VIX Volatility Index