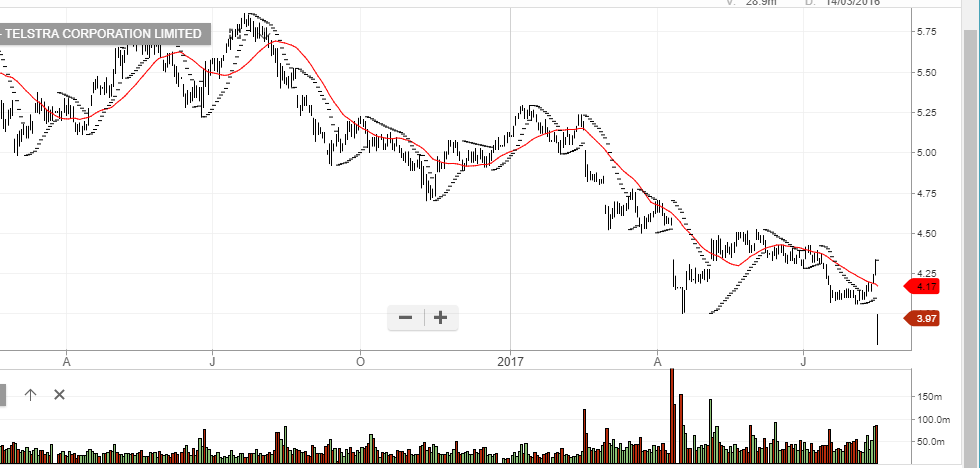

Shares of Telstra have touched a 5-year low near $3.82 in early trade.

Prior to today’s ASX open, the telco giant announced lower profit numbers and a reduction of the current year dividend from 31 cents to 22 cents.

In addition to the ordinary dividend next year, Telstra chief, Andy Penn also announced that the company would return up to 75% of one-off NBN receipts to shareholders via fully-franked special dividends over the next 12 months.

Further, Mr Penn gave an overview of the potential to monetize its NBN payments to support a “capital management” plan to “enhance shareholder returns”, most likely through a series of share buy backs.

With Telstra shares trading at $4.20, a 22 cent yearly total dividend pencils out to a 5.2% yield plus franking credits.

Our base case is that the domestic telco technology sector will continue to show above trend growth relative to peer sectors.

We expect Telstra’s leaner business model will contribute to the company’s profit potential over the next year.

We consider the share price oversold relative to fundamentals and prefer the long side from these levels.

Telstra

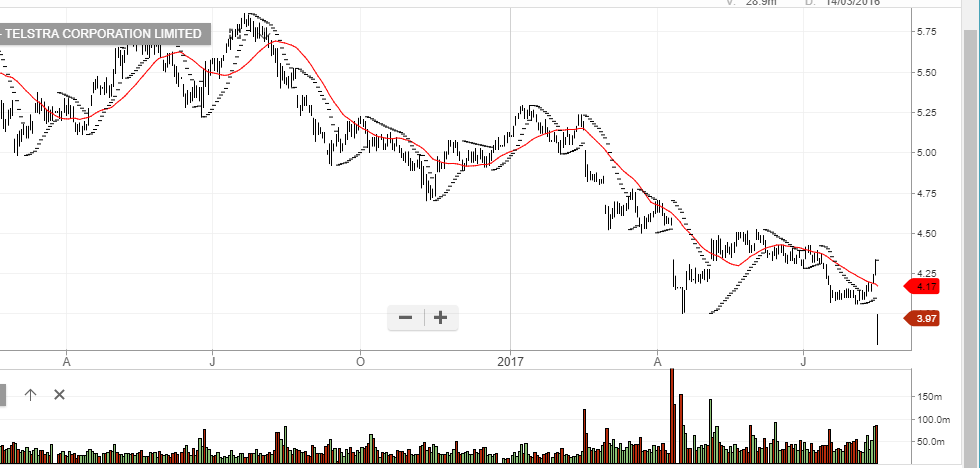

Telstra

Telstra

Telstra