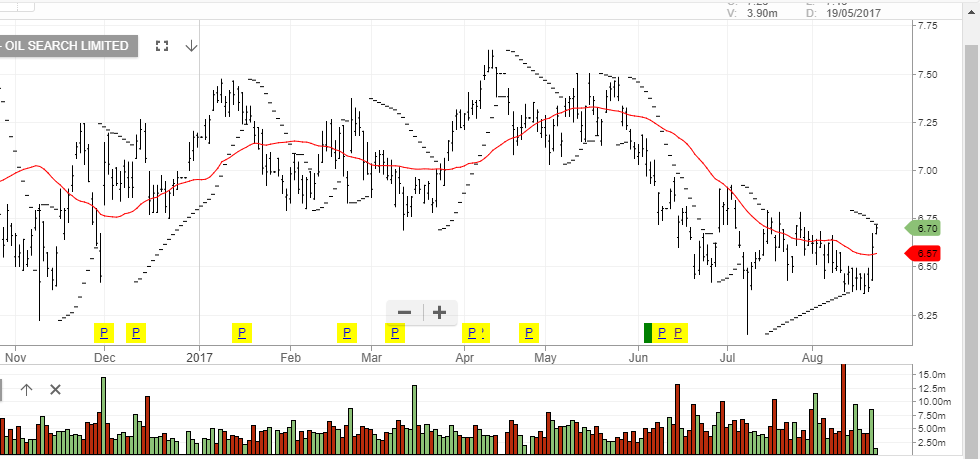

Shares of Oil Search got as lift yesterday as the company announced 1H17 results, which included an underlying NPAT of USD129 million and a higher-than-expected dividend of USD 4 cents per share.

Total profit increased to AUD7.30 per share. OSH management also tightened guidance towards the higher end of production, and the lower end of costs and capital expenditure for the calendar year 2017.

The company expects the PNG LPG yearly production rates over 8.6 metric tons per annum, which is the top end of the last year’s guidance.

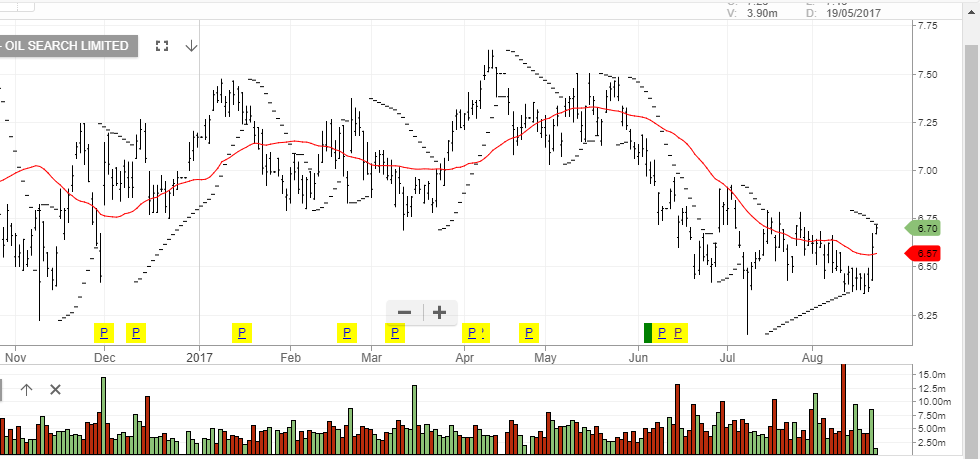

OSH shares have lost over 15% since trading at $7.50 in mid-April.

We see scope for a medium-term lift from the $6.30 support area, but would consider the company a buy/write opportunity at current levels.

Oil Search

Oil Search

Sydney Airports

Sydney Airports

Oil Search

Oil Search