Chart Update – GE

Our Algo Engine triggered a sell signal in GE back in December 2016.

At that time GE was trading at or near $32.50 and since then the stock has sold off and is now trading $26.00.

Our Algo Engine triggered a sell signal in GE back in December 2016.

At that time GE was trading at or near $32.50 and since then the stock has sold off and is now trading $26.00.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

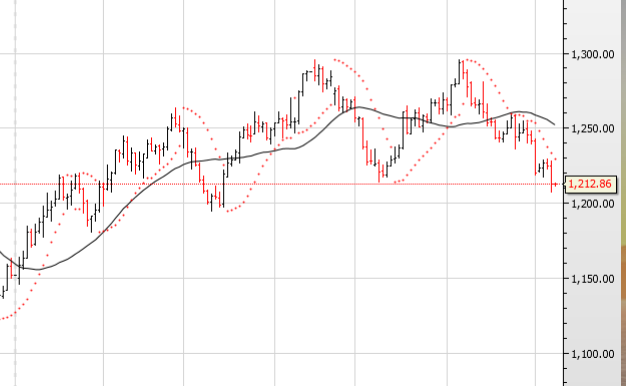

Over the last 7 months, Gold has traded in a broad range between $1200 and $1300.

As inflation, interest rate expectations and equity market risks have fluctuated over that time, so has the price of Gold.

On balance, we expect the $1200.00 support level to hold and find buyers as the yellow metal moves back to the top part of the recent price range.

Investors looking for the price of Gold to move higher can look to buy NCM, EVN or the BetaShare Gold ETF with the symbol: QAU.

Spot Gold

FY17 refining margins have improved from last year after averaging US$12.40 versus US$10 over 1H16.

We expect CTX stock price to find support at the current price level and trade higher off the back of the earnings result announced in August.

Assuming DPS of $1.15, we have CTX on 3.7% yield, and when complimented with a covered call, we ‘re delivering 10 – 12% annualised cash flow.

The S&P/ASX 200 Index finished the week down 0.31%. The best performer was the Materials sector, up 2.1% and the worst performer was the Health Care sector.

The XJO remains below the recent 5850 “lower high” formation, as displayed on the graph below.

Our ALGO engine triggered a buy signal in Cimic Group yesterday on the ASX close at $38.20.

After posting a new 52-week high of $41.10 on May 24th, shares of CIM had pulled back over 8% to 37.50 before recovering into Friday’s close.

A report that CIM is preparing to offload its 23% stake in Macmahon Holdings and restart its share buyback plan helped the stock find buyers.

This, combined with the credit rating upgrade from S&P in late May, gives CIM a positive outlook going forward.

At 23x earnings, the shares are mildly expensive, but the upside potential to $41.00 sets up a reasonable “buy/write” investment opportunity.

CIMIC Group

CIMIC Group

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Our Algo Engine has flagged a buy signal in TCL with the price trading at or near $11.60.

With a 10% underlying dividend growth supported by free cash flow, we feel TCL should trade back up into the $12.25 level, as bond yields retrace from their current short-term rally.

Or start a free thirty day trial for our full service, which includes our ASX Research.