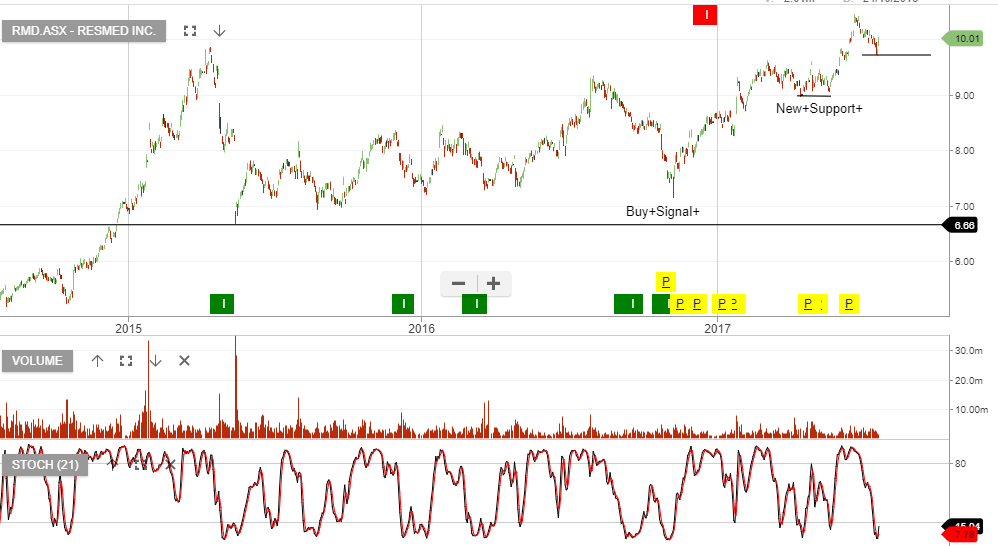

Algo Update – Resmed

Our Algo Engine has triggered multiple buy signals in Resmed, since the stock price began a series of “higher low” formations going back to 2015.

The recent strong rally started in late 2016 after making a low at around $7.00.

With the stock now trading at $10.00, the PE is pushing into the high 20’s.

The upcoming earnings result on the 2nd August will have to deliver 10 – 15% underlying EPS growth to meet market expectations.