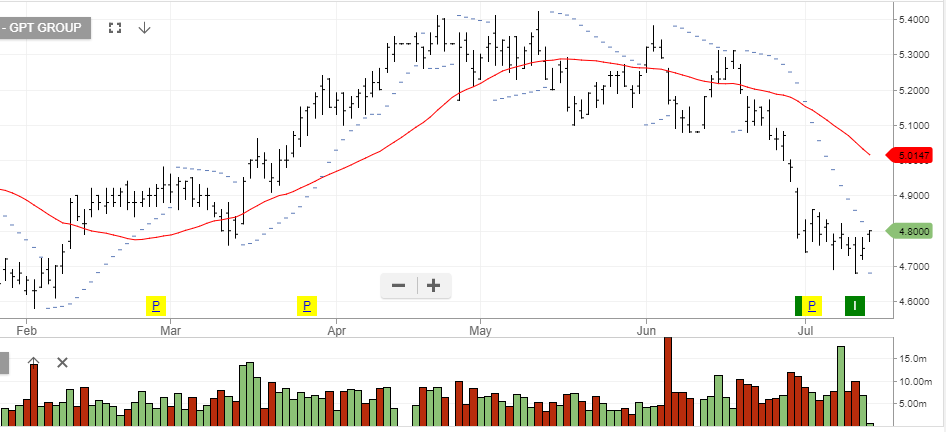

Over the last two weeks, yield sensitive names like SYD, TCL and GPT have all dropped over 10% from recent highs.

One of the main drivers has been the change in interest rate expectations from G-7 central bankers and the subsequent rise in short-term paper.

Moving forward, we see more likelihood of G-7 rates reverting lower within the year’s range and providing upside potential in the stocks above.

Other stocks we like on the basis of lower local rates are: AMC, WOW and MPL.

We see reasonable upside potential in the names and will employ the derivative overlay strategy (selling covered calls) to enhance the portfolios returns.

Transurban

Sydney Airport

General Property Trust