Over the last three trading sessions, volume for the Dow Jones 30 and the ASX 200 have both dropped by about 20% versus their 3-month rolling averages.

Some of the reduction in turnover is seasonal due to the Northern summer. However, many analysts are pointing to tonight’s Senate testimony from FED Chief Janet Yellen as a focal point which has kept traders on the sidelines.

At around midnight Sydney-time, Ms Yellen will address the Senate Banking Committee. She will update lawmakers on interest rate policy, the rate of balance sheet normalization and take questions.

The “cause and effect” logic is that if Ms Yellen’s comments reflect a more “hawkish” position from the FED on rate hikes and reducing the $4.5 trillion balance sheet, US equity markets will trade lower, which will likely spill over to the ASX.

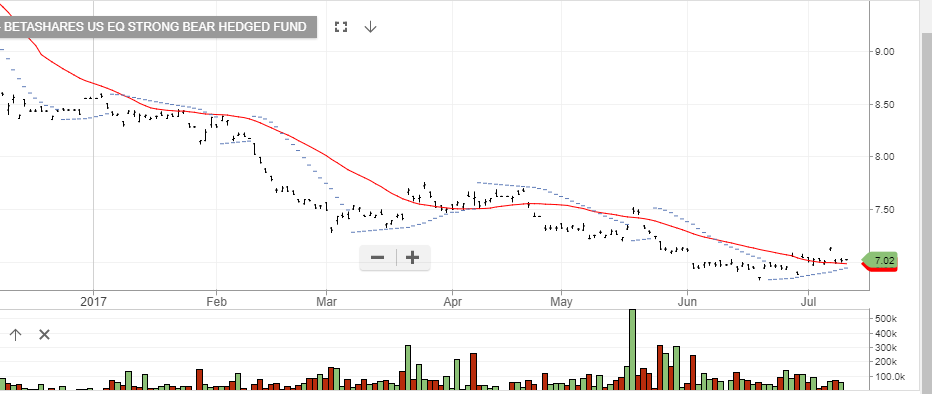

Investors looking to profit from a lower XJO 200 or SP 500 can look to buy the BetaShare ETFs with the Symbol BBOZ or BBUS.

Both of these are inverse ETFs, which means that the unit price will increase as the indexes trade lower.

In addition, both of these ETFs are weighted, which means that a 1% change in the respective index translates to a 2.5% move in the ETF.

BBOZ is currently trading at $17.80, we calculate that the price would rise to $18.60 if the XJO 200 traded back to the June 8th low of 5620.

BetaShare ETF BBOZ

BetaShare ETF BBUS