Shares of Qantas reached a 10-year high of $5.90 on Friday as investors respond to several broker valuation upgrades and the rumor of a credit rating upgrade from Moody’s investor services.

One of the reports forecast a target of $7.09 with an expected dividend of 15 cents per share, which would be more than double the 7 cents per share posted in FY 2016.

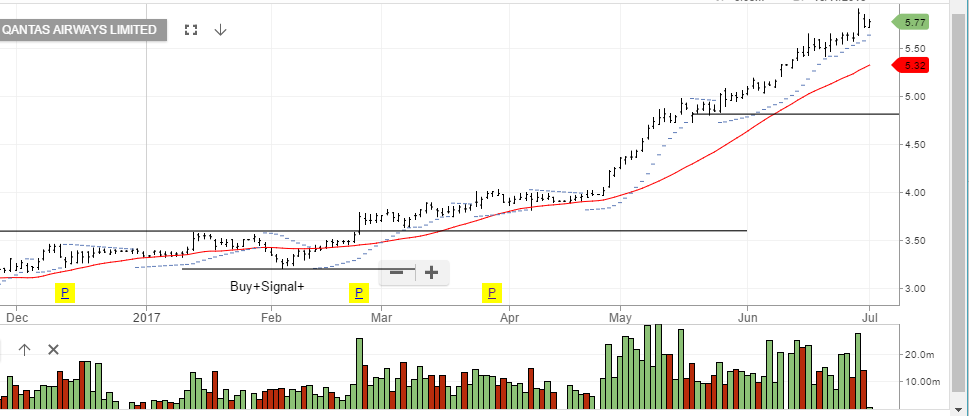

With internal momentum indicators now in overbought territory, we suggest a price reversion lower over the short-term. We will watch the ALGO engine for new signals and expect initial support in the $5.15 area.

QANTAS