At the FOMC meeting this Thursday, the US Federal Reserve is widely expected to raise the Fed Funds target by 25 basis points to 1.25%.

This would be the third increase in the FED’s target band since November and further underscore the fact that the FED is the only G-10 central bank which has an upward interest rate trajectory.

With the RBA maintaining overnight rates at 1.50%, the spread between US and Australian benchmark rates will narrow to a 11-year low of just 25 basis points.

This further narrowing of the carry premium between the AUD and USD will likely put more downward pressure on the AUD/USD.

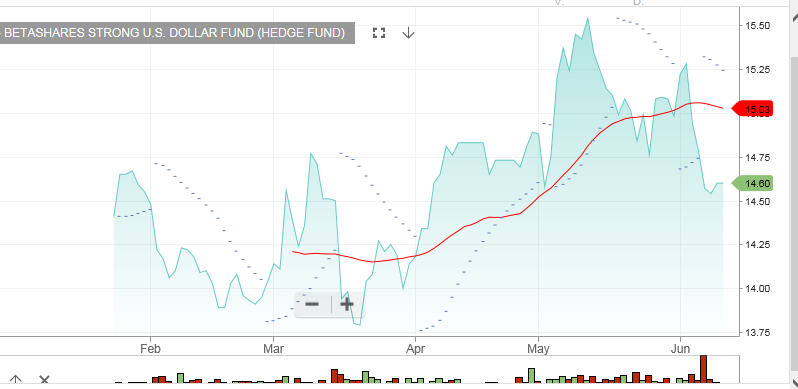

Investors looking to profit from a lower AUD/USD can buy the BetaShare ETF with the symbol: YANK.

YANK is an inverse ETF, which means the price of YANK increases as the AUD/USD trades lower. It also has a weighting of 2.5%, which means the unit price will fluctuate by 2.5% for every 1% change in the AUD/USD exchange rate.

With a current price of $14.70, we calculate that the price of YANK will be near $16.50 as the AUD/USD returns to the January low of .7160.

BetaShare ETF: YANK

BetaShare ETF: YANK