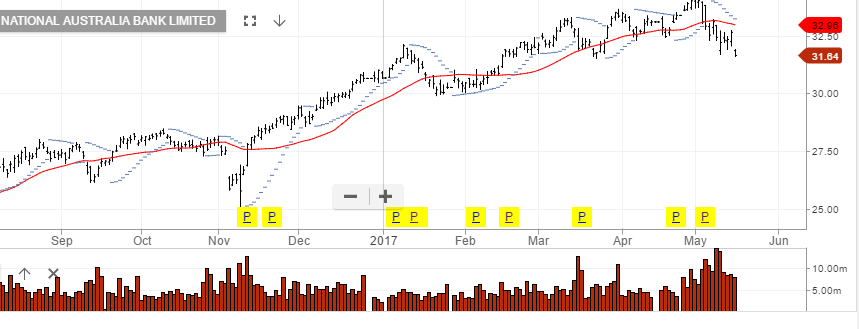

On May 4th, we posted a report that the NAB’s H1 results would likely lead to a sell off back to the January lows of $30.50.

After going ex-dividend today, NAB shares have traded down to $31.65. A combination of the new bank levy and increased bad debt provisions will likely continue to weigh on the stock price.

We maintain our $30.50 target and suggest buying put options into June or selling covered calls to enhance portfolio returns.