The US stock Volatility Index, or VIX, is the industry benchmark for measuring the implied volatility for stocks in the S&P 500 index. It’s often referred to as the “fear index.”

The VIX is a non-directional indicator, since market volatility will increase whether the S&P Index trades higher or lower.

A low number suggests low volatility, and a low level of “fear” that the collective stocks in the S&P 500 are going to stage a sharp move in either direction.

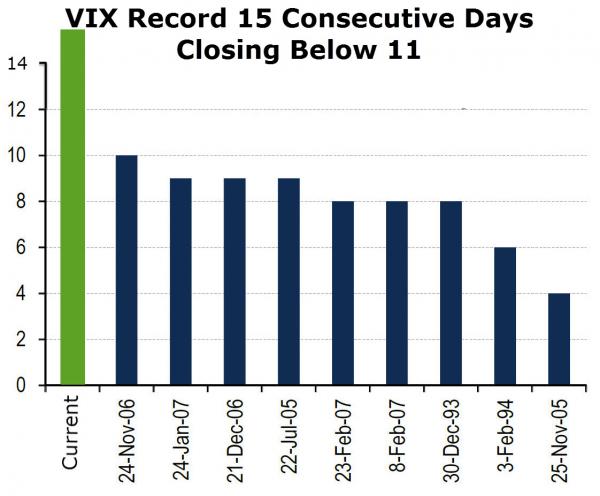

As of Friday’s NY close, the VIX has settled below 11.00 for 15 consecutive trading sessions. This is the longest streak of market complacency since the VIX started trading in 2004.

VIX Index