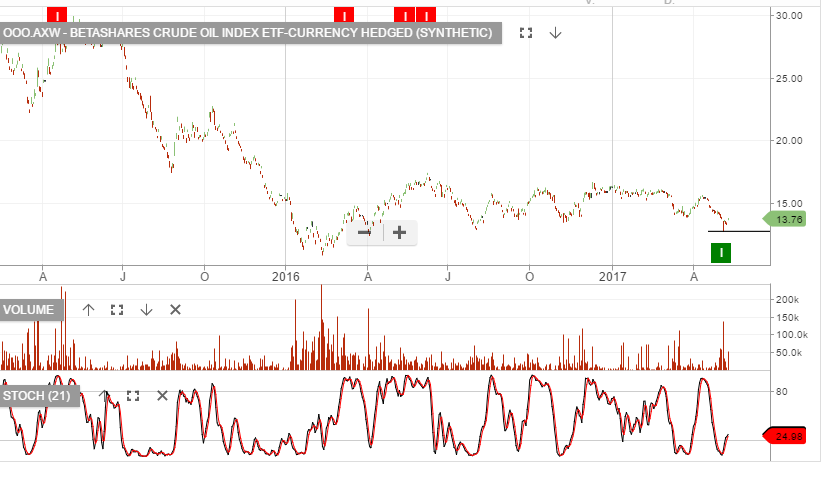

We continue to track the Betashares oil ETF OOO.AXW

Oil prices have rallied from the recent low after this week’s largest inventory drop of 2017. EIA data has revealed U.S. crude stocks fell by 5.2M barrels. In addition, OPEC supply cuts have been agreed to by Iraq and Algeria joined Saudi Arabia.

Concerns regarding the abundant added supply of US shale oil will keep a lid on any meaningful rally, but we may see a bounce from the recent low. Investors should run stop losses under the trend low on both ETF and individual stock names.

Our best performing energy trade has been the long ORG position. However, due to the extended price rally since the Algo Engine buy signal, we’re now inclined to take profit in ORG and consider the OOO.AXW ETF as a replacement.