FY17 revenues were broadly flat on last year at $10.6b. Operating costs were down slightly which helped to produce an approximate 7% uplift in net profit to $2.2b.

FY17 EPS $6.58 and a very solid final dividend of $2.80 takes the payout ratio to 72% and now places the stock on a 5.5% yield into FY18.

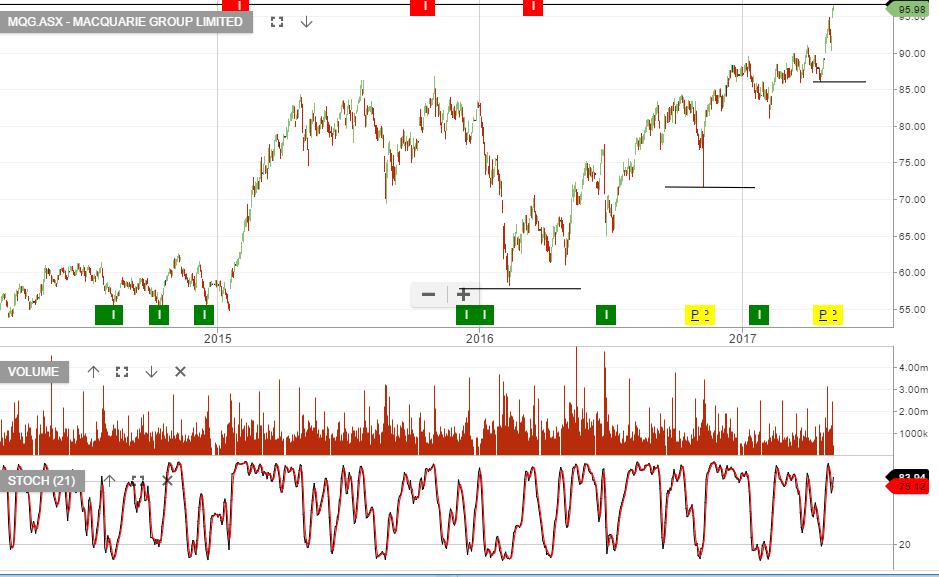

With the stock is up 50% during the last 12 months and now trading on 15x forward earnings, further upside is likely to be limited. Flat revenue will continue to place pressure on management to drive down operating costs.

FY18 forecast revenue $10.5b. net earnings $2.2b, EPS $6.50 & DPS $4.90.