The Spot Iron Ore price continued to trade lower overnight, losing 4.6% to reach a 6-month low of $63.20 per dry tonne. This is a 33.5% drop from the high of $95.00 last traded on February 21st.

It’s worth noting that the sharp selloff is picking up pace just weeks away from the delivery of the Australian Federal Budget.

Since Iron Ore remains the country’s single biggest export, Federal revenue projections are highly sensitive to the outlook for Iron Ore prices.

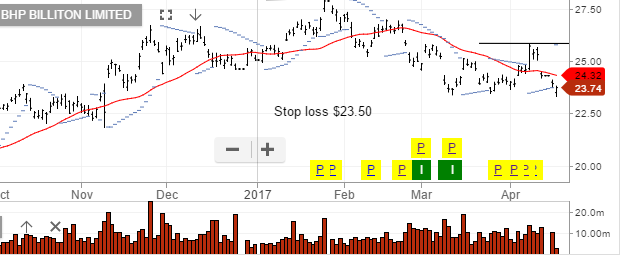

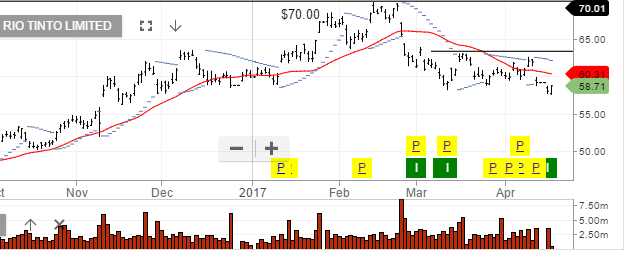

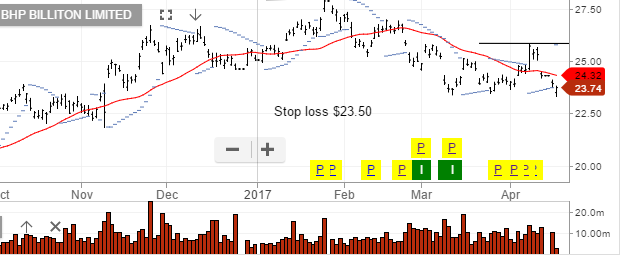

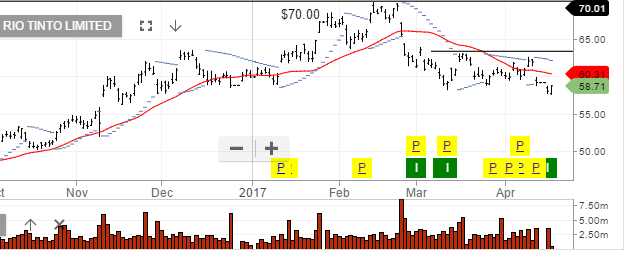

Both RIO and BHP have traded lower on the open, reaching new 5-month lows of $57.60 and $23.30, respectively.

Unless Iron Ore stages a dramatic rebound, we look for the the next key support level in RIO at $56.20, and at $22.60 for BHP.