Banks – Chart Update

The following charts show the correlation of the US bank price performance versus leading ASX banks.

The following charts show the correlation of the US bank price performance versus leading ASX banks.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

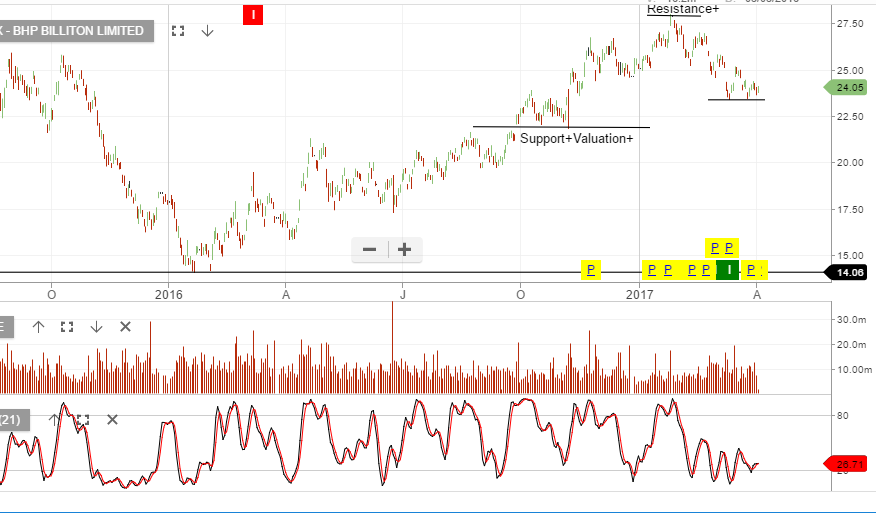

The share prices of RIO and BHP are both approaching key support levels which could create investment opportunities.

The are both trading below their 30-day moving averages but are close to support $58.80 and $23.50, respectfully.

The attached charts show that these support line have held and became good buying levels for a move higher over the last six months.

However, we are mindful of the importance of exports to China for both of these companies. Overnight, China’s five largest banks reported earnings which showed steady results but increases in the percentage of non-performing loans tied to real estate.

It’s worth noting that Chins’a top five banks are considered the largest in the world in terms of assets. A sharp contraction in any of those five could trigger weakness in RIO and BHP

A number of stocks within the ASX top 50 appear to be setting up medium term short signals.

We’re mindful of the upward bias in equity indexes, however, much of this is driven by broad inflows into index funds and valuations are becoming stretched, even if Q1 earnings in the US hit their target.

Here is a list of the names that are worth taking a closer look at….

AMP, LLC, SGP, CPU, JHX, & AGL.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

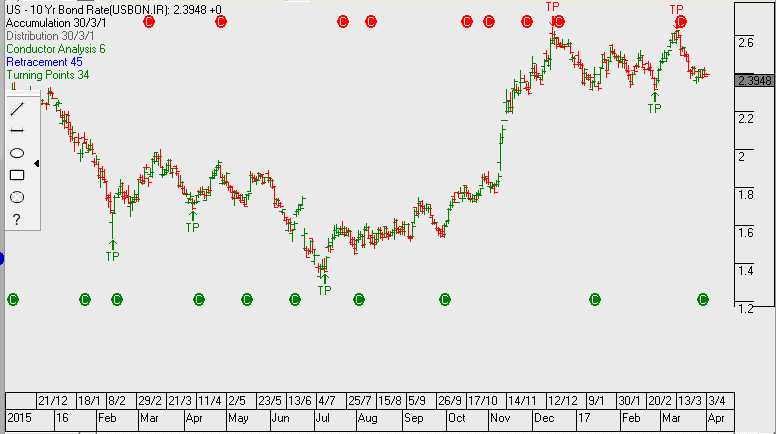

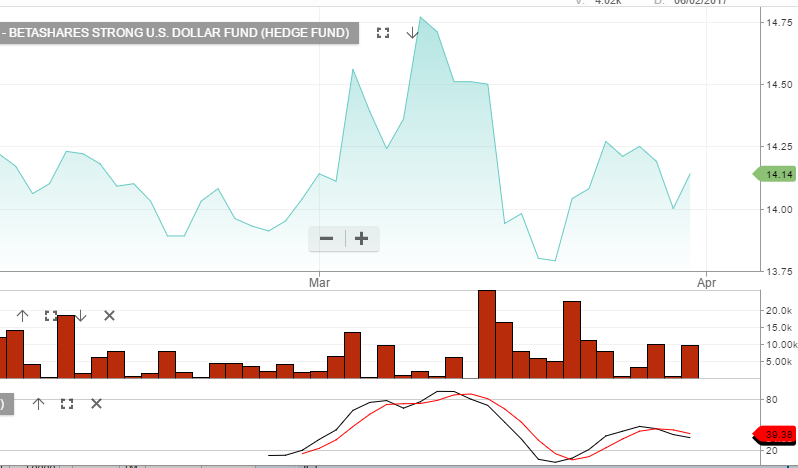

The chart below shows the yield on the US 10YR bonds retracing from a high of 2.62% to now trading at 2.39%. We find this interesting given the positive commentary around US growth and market expectations for further rate rises in 2017.

The by-product of the lower US yield story has manifested in domestic yield sensitive names such as Transurban being among the best performing stocks within the ASX50.

There has been plenty of Central Bank action on interest rates around the world but none of it coming from the RBA.

That trend is very likely to continue at tomorrow’s RBA board meeting where the official cash rate is expected to remain at 1.5%.

Australian monetary policy is currently stuck between underlying inflation, which is below target, and accelerating house prices.

The market may move on comments about the Aussie Dollar or the banks recent out-of-cycle rate rises, and that APRA has again slightly tightened the terms on investor lending.

As such, real estate names will be in focus after the announcement.

The higher low formation at 5680 remains in place.

Or start a free thirty day trial for our full service, which includes our ASX Research.