After falling over 7% last week, WTI Crude Oil dropped another 1% last night to trade at a four-week low of $49.05.

Concerns of oversupply in both Crude and Gasoline are dragging prices down as both products are now trading below their 30 and 50-day moving averages.

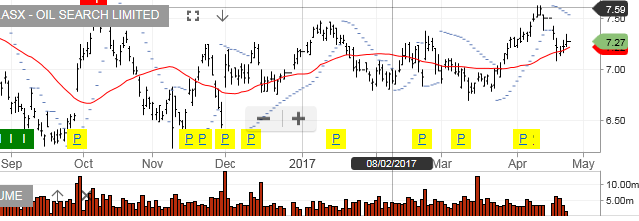

This weakness in both the technical and fundamental indicators will likely put downside pressure on the shares of Oil Search.

On April 19th, Oil Search announced a quarterly report which showed a 2% decline in total production for the March quarter, along with a 1% decline in total sales revenue.

Based on these data sets, we would expect OSH shares to trade back down to the initial support at $6.70 in the near term.

Oil Search