The benign result of the first round of the French elections has triggered a “risk on” relief rally in global financial markets.

As such, Gold opened the Asian session down $20.00 at $1265.00 and has steadily recovered as the reality of the election result settles into the market.

Technically, Gold is still in an uptrend with the 30-day moving average still below the market at $1256.00. We expect Gold to recover and re-test the April 17th high of $1295.00 in the near-term.

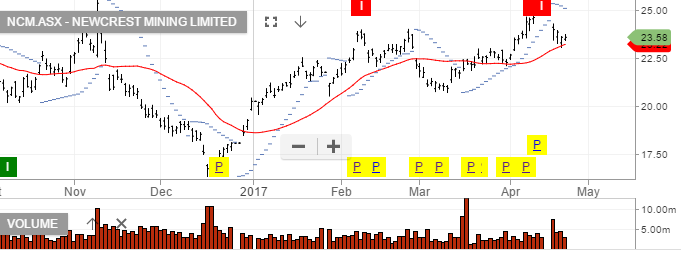

Over the last five trading days, shares of NCM have dropped close to $2.00.

The lower price of Gold combined with the closure of the Cadia mine has pushed the stock down into the buy zone of $23.20; still above the 30-day moving average at $23.00.

We expect both the price of Gold and shares of NCM to rebound and trade higher over the medium-term. Investors looking to profit from higher Gold prices can also look at the QAU BetaShares Gold ETF.