US earnings season will go into full swing next week with several DOW components and high-capitalization S&P 500 companies reporting Q1 earnings.

Thus far, the results have been mixed with IBM missing badly and forward guidance on the major US banks showing concerns for future revenue growth.

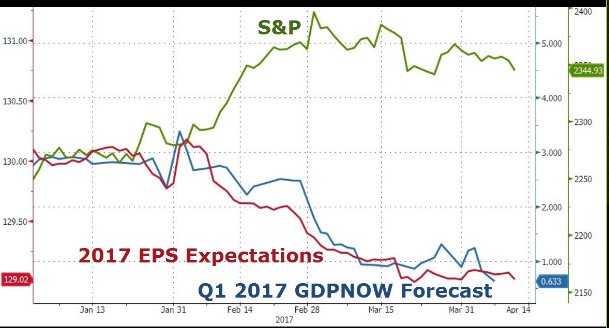

The chart below shows that the expectations of S&P earnings, relative to the current pricing of the S&P 500 index, are very much out of line.

If next week’s earnings reports don’t exceed expectations, we could see further downside range extension on the SP 500 index, which could pressure the XJO index lower.

We have been looking at the May 5800 XJO puts as a short-term portfolio hedging instrument for a move lower in the local market.

We have also been buying the BetaShare BBOZ inverse exchange traded fund. Shares in BBOZ gain value as the local market trades lower.