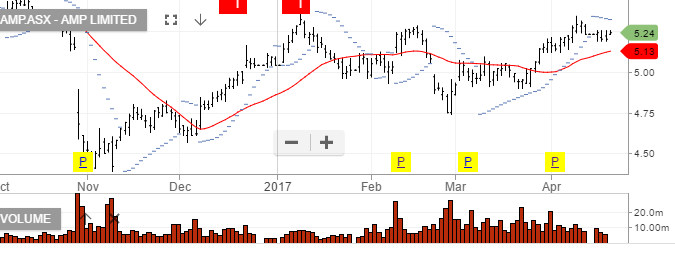

Shares of AMP have been carving out a triple-top pattern since October of last year. Since then, the share price has topped out around the $5.30 level on January 9th, and again on April 4th.

Regular readers will recall that AMP posted a loss of $344 million back in February. This was the company’s first full year loss since 2003 and exposed ongoing concerns about their life insurance and wealth protection divisions.

We are currently holding a $5.00/4.60 put spread into June and suggest investors look at downside opportunities from AMP.

Our near-term target is $4.60, but see scope for a move back to the November low of $4.30.