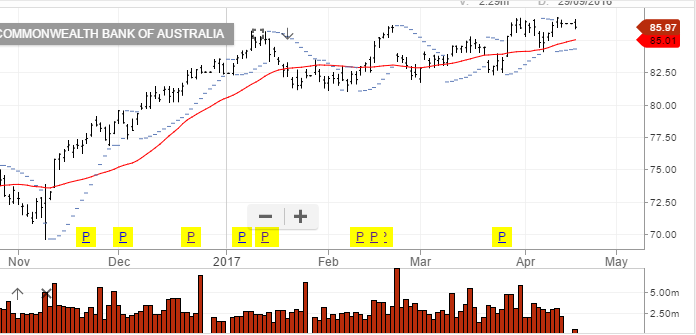

Australian banks are currently trading at lofty levels and close to significant chart resistance points.

We consider CBA to be most vulnerable to a down side correction considering the technical pattern and the premium at which it trades to its peers.

Going back to December 2015, there have been four occasions when CBA shares traded into the $85.00 to $86.00 price range before rolling over for a 5 to 10% correction. At this point, we are looking for a technical move back to the $80.00 level.

Fundamentally, huge consumer debt burdens, stagnant domestic wages growth and an overheated housing market will likely act as a headwind to further meaningful price appreciation.

Investors holding long CBA positions can look to sell covered calls into June, or buy the May $83.00 outright put option.

Suzanne Jarvis says:

May I ask which charting software is being used, please?