Yesterday’s 5% rally in BHP left a many investors wondering what was driving the shares on a quiet Monday session.

The main reason was a report that Elliott Advisors suggested the company could unlock shareholder value by spinning off US Petroleum and collapse of the LTD and PLC shareholdings.

The idea is that the Elliott plan would accelerate the release of value and franking credits. Of course, the $6.00 rally in Crude Oil since March 27th has also been a boost to BHP shares.

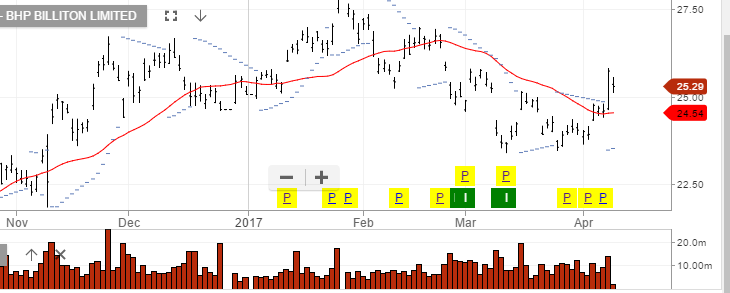

Our ALGO engine generated a buy signal for BHP on March 13th at $23.65.

We remain cautious of the extended valuation of equities, in general, and suggest placing a stop in the $24.40 level on long positions.

Chart BHP

Chart BHP