With the financial media focused primarily on the US missile strike in Syria, many investors didn’t notice the 7% drop in Iron Ore prices on Friday.

The spot price of Iron Ore fell $5.50 to $75.45 yesterday. This is over 20% lower than the February 21st closing price of $95.00.

Making matters worse, the September contract for Iron Ore on the Dalian exchange also closed 7% lower after trading down to its 8% limit for most of the session.

The sharp fall in Iron Ore will have its biggest impact on BHP, RIO and the Aussie Dollar.

The AUD/USD closed the New York session at a 1-month low of .7495. This is the first close below .7500 since early January and opens up the next support level at .7425.

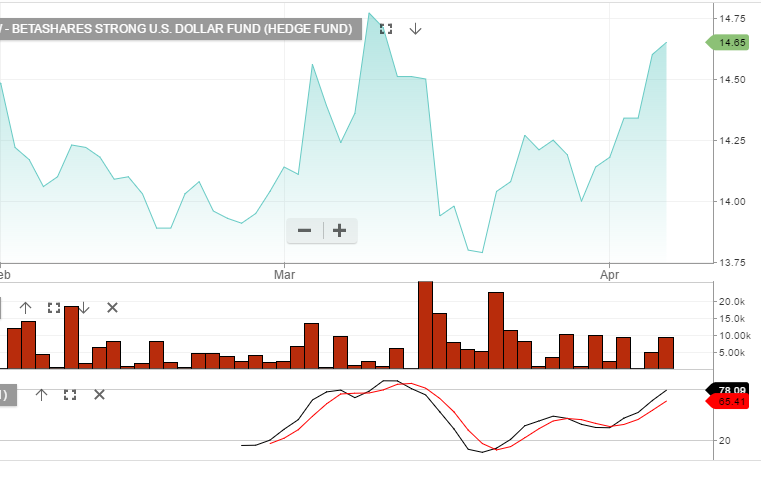

Investors who would like to profit from a lower AUD/USD can look at the BetaShare YANK Exchange traded Fund. This is an inverse fun which gains value as the AUD/USD falls.

Call in for more details about YANK and the other ETFs that we cover.