XJO – Chart Update

The XJO remains range bound with the most current level of support at 5640.

The XJO remains range bound with the most current level of support at 5640.

From yesterday’s group of Algo Signals, we’re now tracking GEM as a potential short.

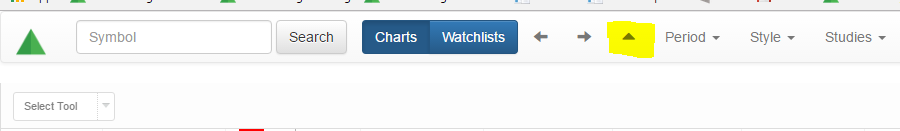

We’ve added a new feature to our charts, which now includes the ability to turn on or off the access or viewing of “Leon’s Chart” function. The image below identifies the highlighted button in yellow. Click this button on your charts to enable the feature.

After reaching a high of $1263.00 on February 27th, the price of Gold has dropped over $45.00 to close today at $1216. 00.

Technically, this price represents the first daily close below the 30-day moving average since January 2nd, and points to the next key support level at $1200.00.

On February 8th, the Investor Signals Algo engine generated a short signal on Newcrest Mining at $23.95. Investors who were holding long positions were given the signal and had the opportunity to sell covered calls, or sell the shares outright.

Shares of Newcrest are now trading near initial support at $21.00.

However, with momentum indicators pointing lower, a realistic near-term target could be found near the former “double-top” high at $20.40.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

The RBA is widely expected to keep interest rates unchanged today.

Foreign Exchange investors will be listening for comments about the Aussie Dollar.

The AUD/USD has risen by 4.5% this year on a trade weighted basis, and RBA Governor Philip Lowe has signalled that the central bank would like a weaker currency.

The sharp improvements in domestic terms of trade (rising coal and iron ore prices) appear to have largely run their course. The AUD/USD was sold through .7600 last week for the first time since late January. Initial support is now seen in the .7530 area.

In the last RBA statement, Governor Lowe made it clear that he was looking at three factors in determining the path for monetary policy: Inflation, the labor market and household balance sheets.

Of these factors, weakness in the labor market looks to be supportive of another rate cut.

Looking at the expansion of household balance sheets suggests the RBA should look to raise rates. However, the benign outlook on price inflation signals that the central bank can leave rates unchanged.

We will see the result at 2:30 Sydney time.

Origin has been triggered as a buy signal from our Algo Engine. We expect the stock to find buying support at or near the current price level.

Since posting a high of $84.00 last September, shares of Ramsay Heath Care have dropped almost 20% to below 67.50 today.

This decline has adjusted the share price to 26 X estimated 2017 earnings. While this multiple is not cheap, it looks like fair value considering Ramsay’s strong long-term growth prospects and dividend history.

Since the private hospital operator started paying dividends in 2007, it has increased its payout to shareholders every singe year. This is a streak that includes 21 consecutive dividend increases.

Based on the last 12 months of dividends, Ramsay’s shares are currently offering a fully-franked 4.8% yield, which tips up to almost 7% when the franking credits are included.

Further, the company has given guidance that 2017 profits could increase by 20%.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.