CSL trades 27x forward earnings.

FY18 revenue to grow 5% to US$7b, EBIT +18% to US$2.2b, EPS US$3.60 & DPS US$1.70.

This places CSL on a forward yield of 1.8% into FY18.

We own CSL and recommend a covered call into the $130 range to enhance the yield.

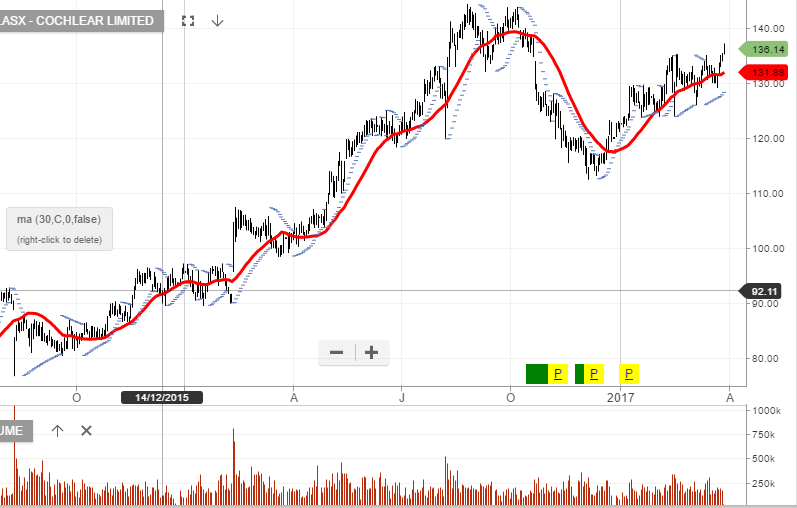

Cochlear was recently triggered by the Algo Engine as a buy signal and we update our 12-month share price target to $138 based on a PE of ~27.5x. and a forward yield of 2%.

Risks remain associated with COH reimbursement changes, regulatory

intervention and adverse currency movements. However, momentum favors the stock at present.