The price of West Texas Crude Oil fell over 5% last night as the US Energy Information Administration (EIA) reported an 8.2 million barrel increase in domestic crude supplies. This lifted the total crude inventories to a new record of 528.4 million barrels in storage.

The front-month April contract broke the recent consolidation pattern to trade down to a 3-month low of $50.05, just above the important $50.00 support level.

A corrective bounce higher after such a large 1-day move is likely. However, with storage at all-time highs, more supply coming online and consumption numbers falling, a $48.00 price handle looks more probable than a $52.00 handle over the medium-term.

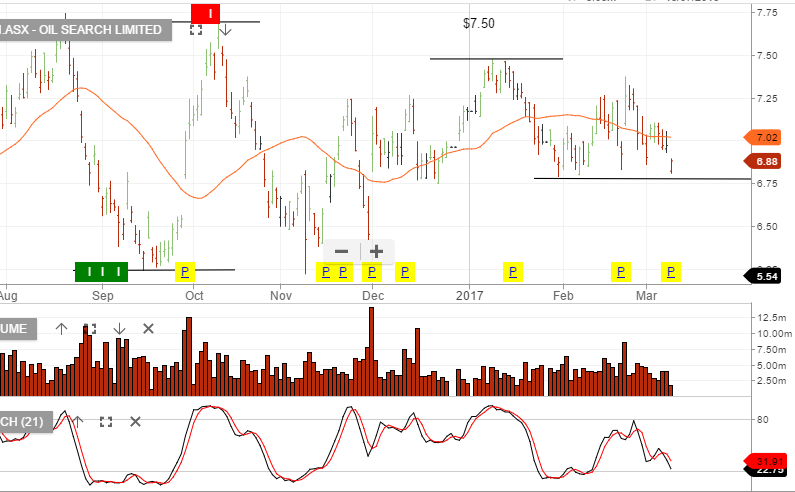

Shares of Oil Search have held above the recent low of $6.80, but look vulnerable to further downside.

The Investor Signals Algo Engine triggered a short signal at $7.72 on October 10th.

Technical studies suggest a break of the $6.75 level will see the stock revisit the November lows near $6.20.