In remarks earlier today, Fed President Janet Yellen indicated a readiness to raise the US funds rate at the FOMC’s March 14-15 meeting.

In fairly explicit language, she said that as long as “employment and inflation are continuing to evolve in line with expectations”, “a further adjustment of the federal funds rate would likely be appropriate”.

As a result, we now see a hike at the March meeting as close to a done deal, and see the market probability raised to 95%.

Considering the fact that the Fed Funds futures contract was reflecting a probability of around 30% just over a week ago, this has been a very sharp turn in policy sentiment.

As a result, US 10-year yields touched 2.52%; close to a 3-month high.

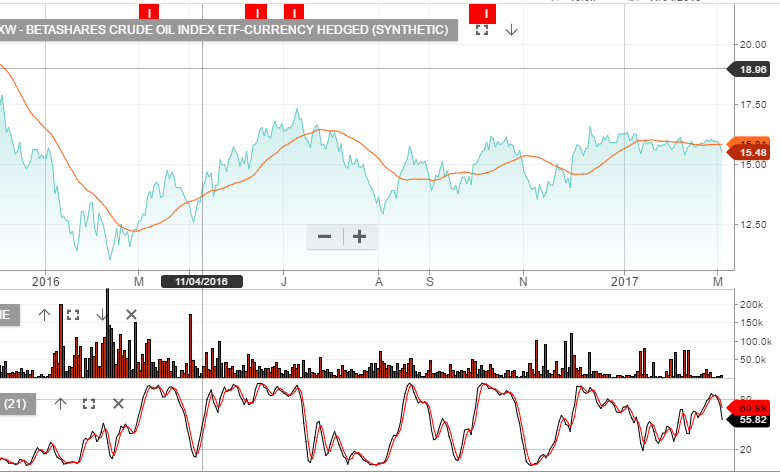

In typical market conditions, a US rate hike is Bullish for the US Dollar and Bearish for Stocks, Commodities and Crude Oil