AMP – Short Signal

Our Algo Engine generated a short signal in AMP at or near the January high of $5.37. The stock is now trading down 10% at $4.83

Our Algo Engine generated a short signal in AMP at or near the January high of $5.37. The stock is now trading down 10% at $4.83

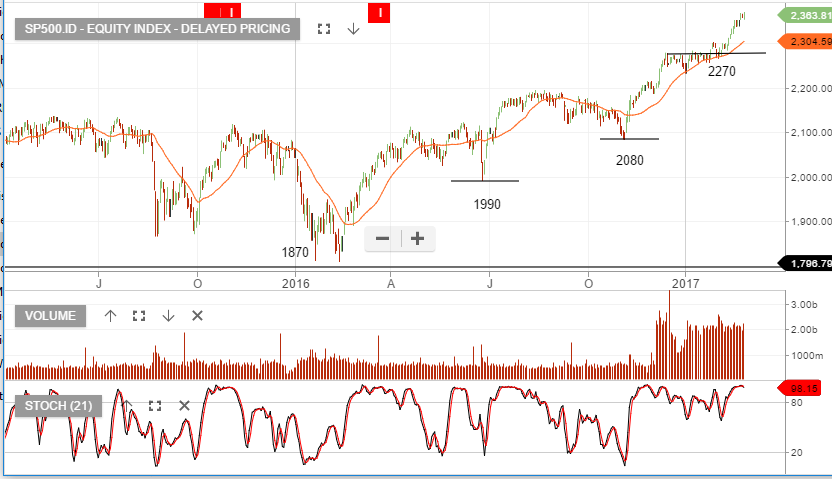

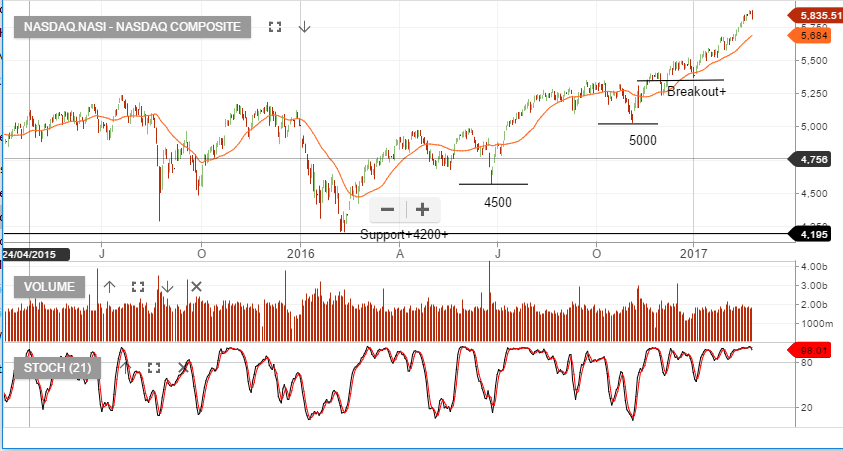

A late push on Wall Street helped US Stocks recover and allow the DOW JONES 30 Index to extend its winning streak to an 11th day.

For the week, the DOW rose 1%, the SP 500 picked up 0.7% and the NASDAQ closed out the week pretty much unchanged.

Looking ahead to next week, President Trump will deliver a speech before a joint session of Congress, when he is expected to give more details about his tax plan, trade policies and the direction of health care in the USA.

It’s interesting to see that the Investor Signals ALGO engine gave a sell signal for 2 pharmaceutical companies today: Eli Lilly (LLY) and Pfizer (PFE). Those sell signals were posted at $82.85 and $34.25, respectfully.

US Drug companies have shown weakness on Mr Trump’s comments about health care reform in the past and investors will be listening closely to his speech on Tuesday.

A quick roll through the charts of the Dow Jones and the top 30 stocks that make up the index.

This is a great way to see the investment trends of some of the world’s largest companies.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

The DOW Jones 30 Index posted its 10th straight winning day in a row overnight. The fact that each one of those 10 winning days was a new record high has not been achieved since 1987.

This most recent leg higher in Dow started on November 8th, after the result of the US election. Since then, the DOW has gained 2,515 points, or 13.75%.

A widely held theme for the US equity rally has been the reflation of the US economy under a more business-friendly administration. This reflation theme was largely based on across the board tax cuts and a country-wide infrastructure construction plan.

The idea being that these new policy measures would stimulate growth and push inflation, interest rates and stock prices higher. Along these lines, the yield on the US 10-year note climbed over 83 basis points, or 6%, from mid-November to late December.

However, over the last several weeks, the US yields have stopped moving higher and the Treasury curve has stopped steepening. In fact, over the last 10 day rally in the DOW, yields on the 10-year notes have actually dropped from 2.48% to 2.37%.

In short, while the DOW has firmed to new highs over the last 10 sessions, the inflation part of the reflation trade is beginning to fade.

From a traditional value-metric point of view, if the recent move higher in US stocks were signalling a new leg higher in valuations, we would have expected the 10-year yields to have traded higher, not lower.

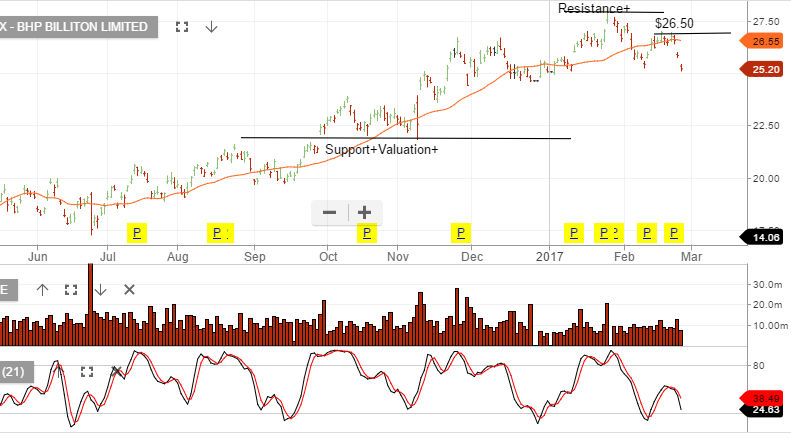

We’ve sold $27 call options over BHP into April and quit all other metals exposure. Our preference for BHP over other resource names is based on our assumption that energy prices will remain supported in the near term.

Three factors will likely support energy prices short term: The Trump administration’s policy will likely be bullish for energy, OPEC and Saudi production cuts and the Saudi Aramco IPO early next year (biggest IPO in history). The IPO will be better received in a supportive energy environment.

For this reason we’ve kept BHP, and sold at the money call options to boost cash flow to 10 – 12%.

We’re not overweight the stock since we see risks building for the market, in general, and Iron Ore prices, specifically.

Chart – BHP

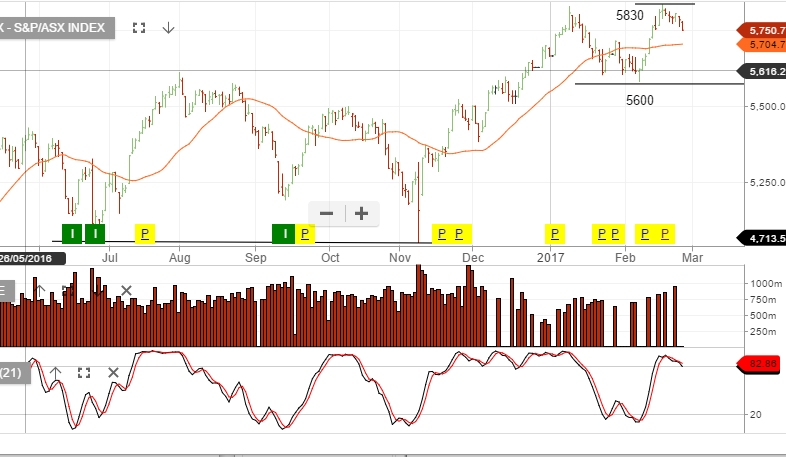

We’ve been cautious of the resource names rolling over from the recent highs and the potential negative impact on the overall XJO index. It appears that the broader Australian market may be in the early stages of a price correction.

Also, the Australian banks appear fully valued given the low revenue and profit growth outlook across the next 12 to 18 months.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Insurance Australia Group (IAG) reported a 4.3% drop in first-half profits to $446 million, which was down from $466 million from the previous corresponding period but slightly higher than the street’s expectations.

Amid an atmosphere of increased claim pressures, Australia’s largest insurer by market share announced its gross written premium grew by 4.7% to $5.8 billion.

IAG declared an interim, fully franked, dividend of 13 cents per share to be paid on March 30th. This dividend represents a cash payout ratio of 64.3 %.

Or start a free thirty day trial for our full service, which includes our ASX Research.