We’ve sold $27 call options over BHP into April and quit all other metals exposure. Our preference for BHP over other resource names is based on our assumption that energy prices will remain supported in the near term.

Three factors will likely support energy prices short term: The Trump administration’s policy will likely be bullish for energy, OPEC and Saudi production cuts and the Saudi Aramco IPO early next year (biggest IPO in history). The IPO will be better received in a supportive energy environment.

For this reason we’ve kept BHP, and sold at the money call options to boost cash flow to 10 – 12%.

We’re not overweight the stock since we see risks building for the market, in general, and Iron Ore prices, specifically.

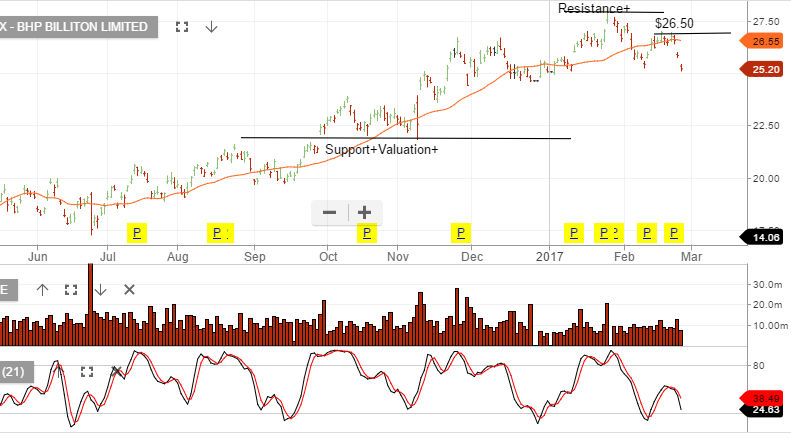

Chart – BHP