The headline data from ANZ shows that the bank had a strong start to FY 2017. However, the pick-up in property and trading income are going to be difficult to replicate into H2 2017.

ANZ delivered around $2 billion in cash profit, which was well above the street’s expectations of $1.7 billion. The higher numbers were underpinned by strong trading income and a $283 million bad debt charge versus an expected $446 million charge.

We note that historically ANZ has had higher Q2 bad debt charges compared to Q1

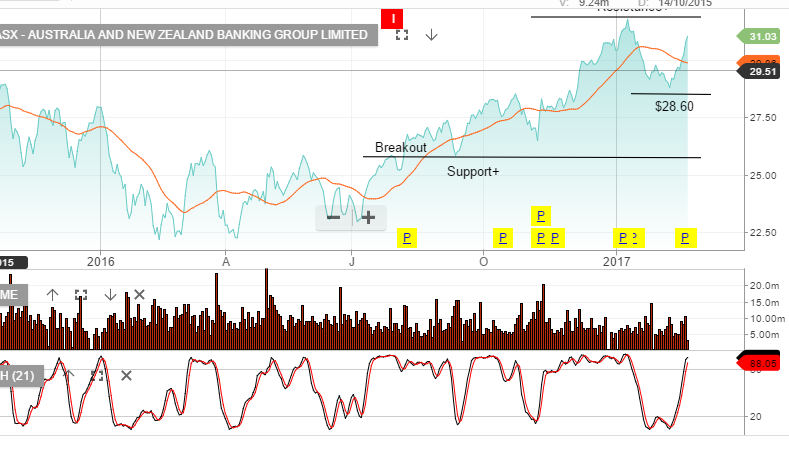

We would expect price resistance to emerge at or around the January 9th high of $31.80.