US banks, (see chart below of JP Morgan), are breaking to the upside of their recent consolidation range, and this is likely driving the rebound in the share price of the Australian banks.

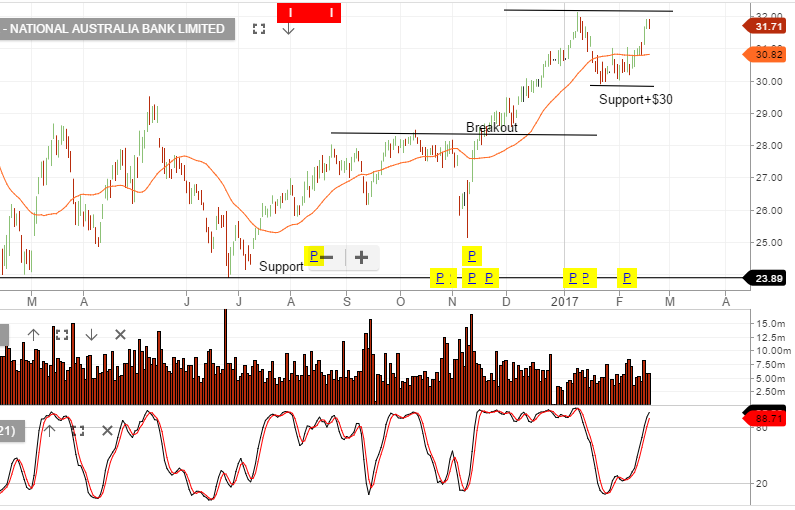

NAB reported a 1% fall in earnings following weak revenue growth and a pickup in expense growth. Bendigo Bank failed to deliver growth at the top or bottom line.

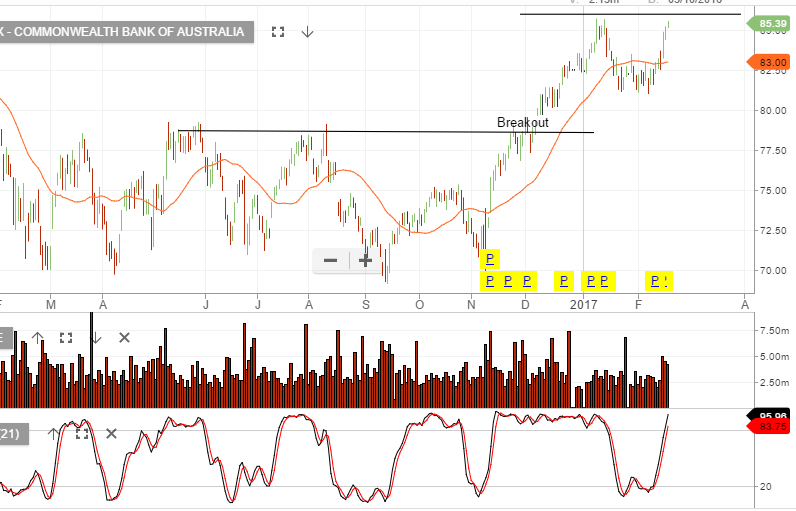

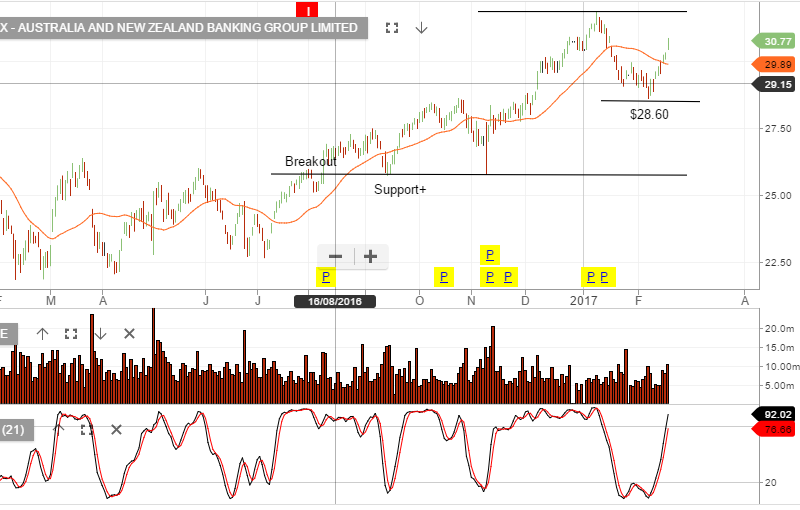

CBA reported slightly ahead of expectations with underlying profit growth of 2.8% or $4.9b for the half. ANZ’s quarterly update, (released Friday), reported a 31% rise in profits to $2b for the 3 months to December.

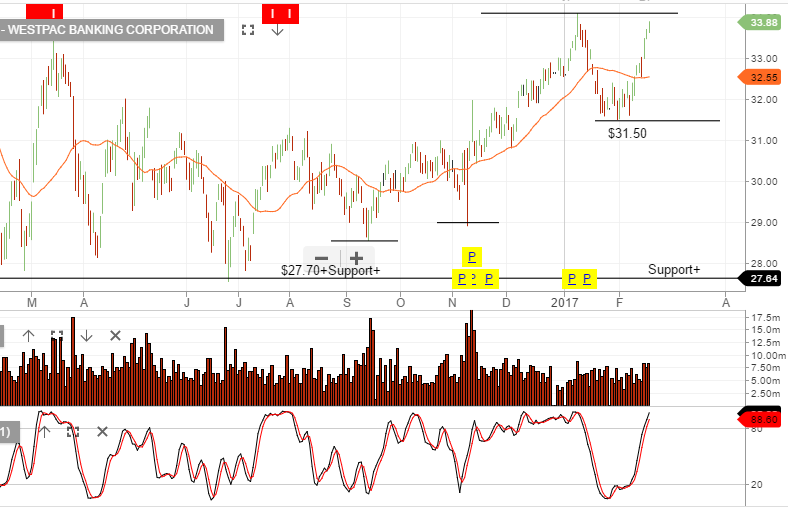

Across all banking results, the NIM or net interest margins, remain under pressure, as does top line revenue growth. These are the same concerns which caused the 10% sell off in banks at the start of this year.

We’ll watch with interest how prices behaves in both the XJO and our major banks this week, as we commence trading with price levels similar to the peak of early January.