The National Australia bank (NAB) announced that Q1 profits have dropped 1% to $1.6 billion and rising staff wages and increased redundancy costs diluted the bank’s earnings.

In an update this morning, NAB reported revenue increased by 1%, but expenses, including a 5% pay rise for staff, grew faster. The bank said the rise in staffing costs was mainly due to a new enterprise agreement that came into effect in October and redundancy payments to staff who left the bank.

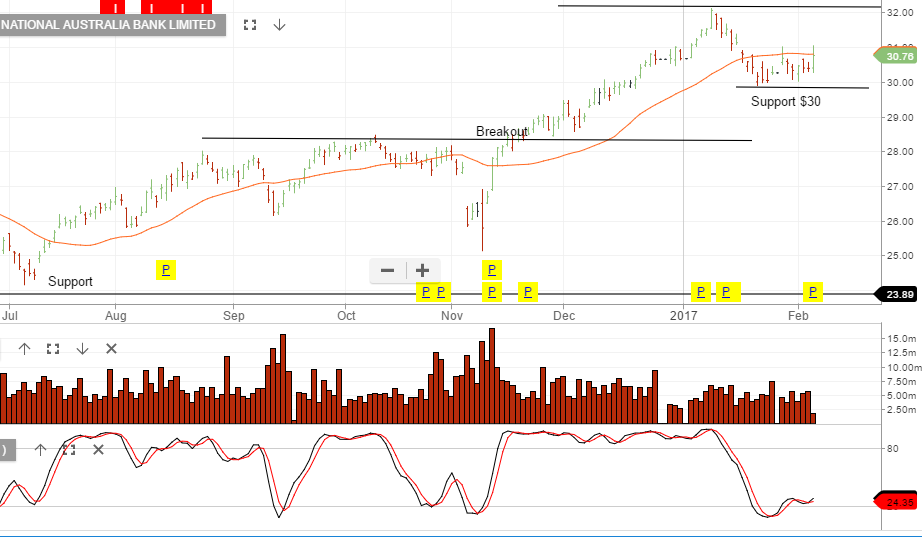

US banks rallied on Friday night which is helping to support our local bank names today. We give the bounce the benefit of the doubt but a break below recent support levels will likely see another 5 – 7% correction to the downside.