Early Days on The Bank Hedge

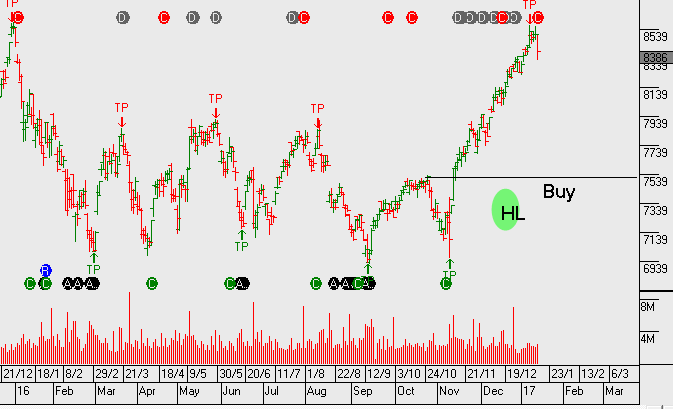

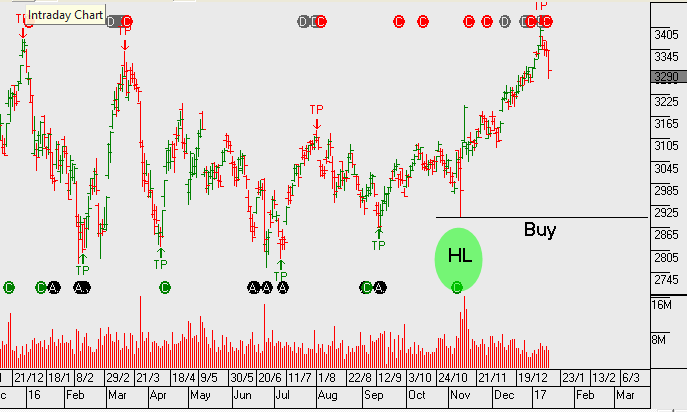

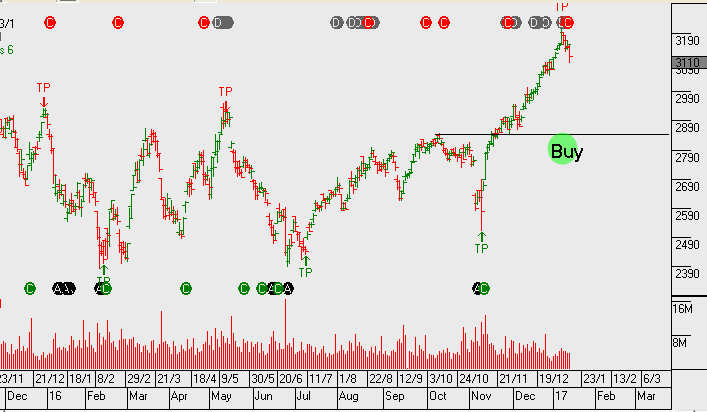

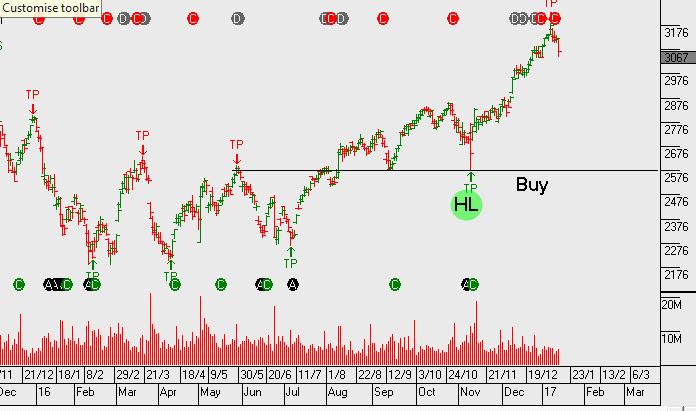

We’ve been running a hedge on the Australian banks; CBA through an in-the-money European March option, NAB using an in-the-money American February option and WBC a longer-term call option. In ANZ our preference has been to exit the trade altogether.

On Friday, our domestic banks started to see some profit taking and the catalyst could’ve been selling ahead of the US banking results and/or the announcement of weaker export data out of China.

JP Morgan and BoA’s results , released last night, were adequate on the bottom line but both companies missed on the revenue front. Increased dividends and share-buybacks helped support what otherwise would’ve been viewed as weak results.