BHP’s recent production results were on the weak side, with lowered expectations in metallurgical coal, energy coal and copper.

The firm has cut its guidance for copper production by 2%, but has maintained their FY 2017 production guidance for other commodities. Copper and energy coal were the weakest spots, with those numbers missing analysis’ forecasts by 11% for both commodities.

Metallurgical coal output was 7% weaker than forecast, while Iron-ore and petroleum production was broadly inline with expectations.

Based on these numbers, BHP will need to deliver a significant uplift in production rates during the 2nd half of 2017 for copper and coal if the upper-end of their guidance is to be achieved.

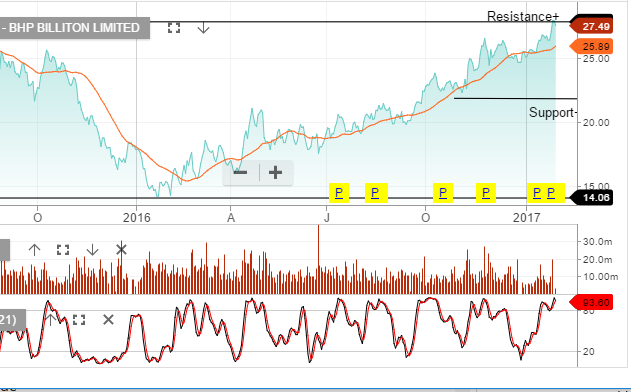

We believe that BHP is up for the task. At current prices, shares are trading on +11% free cash flow and have a positive chart pattern over the last 12 months. Despite the weaker production result, we see scope for a move to $28.00 in the medium-term.